The loan to value ratio (LTV) is one of the primary metrics used by real estate lenders when underwriting loans for rental properties, BRRRR’s and flips. Simply put, it shows the percentage of a property’s value that is taken up by the loan amount.

For lenders, it is a measure of a loan’s risk and the likelihood of a default by the borrower. It is often used together with the loan to cost (LTC) and the debt service coverage (DSCR) ratios to determine loan eligibility, interest rates, and the maximum loan amount a lender will underwrite.

For investors and property owners, the LTV can be used as a measure of leverage and equity they have in each property, and as an indicator of when it may be time to sell or refinance to take advantage of the accumulated equity.

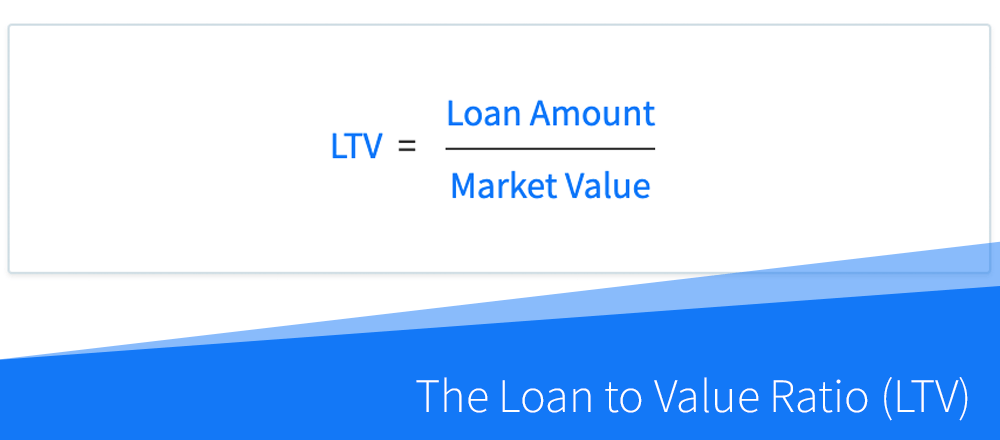

The Loan to Value Ratio (LTV) Formula

The loan to value ratio is calculated by dividing the total loan amount by a property’s current appraised or market value. It is expressed as a percentage:

In the formula above, the loan amount is either the starting amount of a new loan (in the case of a new property purchase) or the current outstanding loan balance (when calculating LTV for owned properties).

A property’s market value is usually determined by a professional appraisal, although some lenders may adjust this amount down based on their specific guidelines and criteria when underwriting new loans.

How Lenders Use LTV To Assess Loan Risk

Let’s suppose a lender is considering two property loans for potential underwriting.

The first property’s appraised value is $100,000, and an investor is willing to put down $10,000 as a down payment, so she will need a $90,000 loan to cover the rest of the purchase price. The LTV for this property is calculated as $90,000 / $100,000 = 90%.

In the second case, the property’s current value is $500,000 and the investor is asking for a $400,000 loan. In this case, the LTV is $400,000 / $500,000 = 80%.

Although the second property requires a higher loan amount, it has a lower LTV ratio of 80%, which (all other things being equal), is usually more attractive and less risky to the lender.

A higher LTV ratio means that there will be less initial equity in the property and the loan amount will represent a higher percentage of the property’s value. For the lender, this increases underwriting risk, not only because the investor may be more likely to walk away from a property with less equity, but also because the lender may not be able to sell it in the event of a default for enough cash to repay the loan.

So, lenders prefer loans with lower LTV ratios, and most of them will have a maximum LTV they will allow for each property and loan type. If the LTV for a proposed loan exceeds this threshold, they may deny the loan altogether, or increase the interest rate of the loan to offset the added risk.

Most lenders will also look at other ratios alongside the LTV, like the loan to cost ratio (LTC), debt service coverage ratio (DSCR), and the debt yield, when evaluating and underwriting new loans.

What Is a Good LTV Ratio?

While specific requirements will vary from lender to lender, most conventional loans will have a maximum loan to value requirement of 80%, which means that you will have to put down at least 20% on the loan.

When buying properties with the intention to live in them (for example, using the house-hacking strategy), it is possible to find lenders willing to offer financing with higher LTV ratios, especially if you’re using owner-occupied loans like the FHA or VA loan. In those cases, the LTV can be as high as 97% for FHA loans, and as high as 100% for VA loans.

The drawback of using these types of loans with higher LTV ratios is that most lenders will require you to pay additional monthly fees, called private mortgage insurance (PMI), until the loan’s LTV ratio falls below 80%.

For non-conventional financing (for example, commercial or portfolio loans), LTV requirements are usually more stringent. Most commercial and portfolio lenders have a maximum loan to value requirement of 70%, requiring a 30% down payment on each loan.

The most straightforward way to reduce a loan’s LTV ratio to satisfy underwriting requirements is to put down a larger down payment and reduce the loan amount. When that is not possible, investors will sometimes seek gap or other forms of secondary financing to help them provide down payment capital for the primary loan.

Using LTV to Increase Rental Portfolio Growth

While your lender will most certainly use the loan to value ratio when underwriting loans on new property purchases, LTV can also be used to help you grow your rental property portfolio by monitoring leverage and re-deploying accumulated equity effectively.

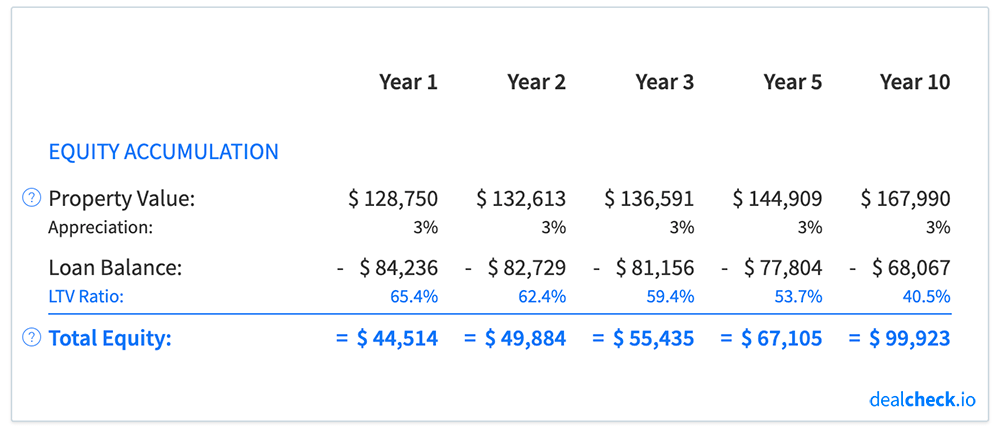

As each rental property’s loan principal is paid down, and as the property’s value appreciates, the LTV will go down over time, as your equity in that property increases:

Since leverage can help you increase and compound your returns (specifically your ROI and IRR), most investors prefer to stay leveraged to a certain extent, for example between 50-80%, throughout the growth stage of their portfolio.

The LTV is a direct measure of leverage for a given property, and can therefore be used to determine an appropriate time when an investor may choose to do a cash-out refinance to withdraw some of the accumulated equity, or sell the property altogether and re-deploy the capital into more profitable investments.

You can look at the LTV ratio both for each individual property, as well as your entire portfolio, to help plan future growth and keep your cumulative returns high. Another metric that can also be used alongside the LTV for this purpose is the return on equity (ROE).

Calculate LTV and Dozens of Other Metrics in Seconds

The DealCheck property analysis app makes it easy to calculate the loan to value ratio, along with dozens of other property analysis metrics for rental properties, BRRRR’s, flips, and rehab projects in seconds.

You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device.