The loan to cost ratio (LTC) is often used by hard money and commercial real estate lenders when underwriting loans for flips, BRRRR’s and new construction projects. Simply put, it shows the percentage of a project’s total cost that is financed by the lender.

For lenders, it is a measure of a loan’s risk and the likelihood of a default by the borrower. It is often used together with the loan to value (LTV) and the debt service coverage (DSCR) ratios to determine loan eligibility, interest rates, and the maximum loan amount a lender will underwrite.

While the loan to value ratio is more commonly used when underwriting loans for rental properties and other stabilized real estate assets, the loan to cost ratio is commonly used for new construction developments, house flips, and other projects that have significant up-front costs.

The Loan to Cost Ratio (LTC) Formula

The loan to cost ratio is calculated by dividing the total loan amount by a project’s total cost. It is expressed as a percentage:

In the formula above, the loan amount is simply the starting amount of a proposed new loan.

A project’s total cost will typically include the purchase price of the land or the property, the rehab costs (for flips) or construction costs (for new construction projects), as well as any other miscellaneous costs paid to complete the project.

How Lenders Use LTC To Assess Loan Risk

Let’s suppose a lender is considering two loans for potential underwriting. We will use fix & flip projects for this example, but the same principles can be applied to new construction projects as well.

The first flip has a $50,000 purchase price and a $50,000 rehab budget, for a total project cost of $100,000. The investor is willing to put down a $10,000 down payment and requires a $90,000 loan. The LTC of this project is calculated as $90,000 / $100,000 = 90%.

In another case, an investor is buying a property for $150,000 and rehabbing it for $100,000, for a total project cost of $250,000. They are asking for a $200,000 loan. In this case, the LTC is $200,000 / $250,000 = 80%.

Although the second project requires a higher loan amount, it has a lower LTC ratio of 80%, which (all other things being equal), is usually more attractive and less risky to the lender.

A higher LTC ratio means that the lender will be providing financing for a larger portion of the project’s total cost, whereas the borrower will be providing less of their own capital. For the lender, this increases underwriting risk, not only because the investor may be more likely to walk away from a project with less of their capital invested, but also because the lender may not be able to sell the asset in the event of a default for enough cash to repay the loan.

So, lenders prefer loans with lower LTC ratios, and most of them will have a maximum LTC they will allow for each project and loan type. If the LTC for a proposed loan exceeds this threshold, they may deny the loan altogether, or increase the interest rate of the loan to offset the added risk.

Most lenders will also look at other ratios alongside the LTC, especially the loan to value ratio (LTV) and the debt service coverage ratio (DSCR) when evaluating and underwriting new loans.

What Is a Good LTC Ratio?

While specific requirements will vary from lender to lender, most hard money and commercial lenders have a maximum LTC requirement of 80% – 90%, which means borrowers will need to provide a 10% – 20% down payment on the cost of the project.

It is common for lenders to also have a maximum LTV requirement, in addition to their LTC requirement. LTV requirements are usually lower (more restricting) and can be somewhere in the range of 70% – 80%, depending on the lender.

The most straightforward way to reduce a loan’s LTC ratio to satisfy underwriting requirements is to put down a larger down payment and reduce the loan amount. When that is not possible, investors will sometimes seek gap or other forms of secondary financing to help them provide down payment capital for the primary loan.

Loan to Cost vs. Loan to Value – What’s the Difference?

Loan to cost (LTC) and loan to value (LTV) ratios are often used together by lenders when assessing loan risk and underwriting new loans, and are both a measure of financial risk taken on by the lender.

There are, however, a few important differences between these two ratios:

How It’s Calculated

- LTC: Calculated by dividing the loan amount by a project’s total cost

- LTV: Calculated by dividing the loan amount by a project’s (or property’s) total value after project completion

What Are the Maximum Requirements

- LTC: Usually in the range of 80% – 90%, depending on the lender

- LTV: Usually lower than LTC requirement, in the range of 70% – 80%, depending on the lender

When It’s More Often Used

- LTC: When underwriting hard money and commercial loans for flips, BRRRR’s or new construction projects

- LTV: When underwriting a wide range of real estate loans, including conventional, rental, portfolio, but also the types mentioned above

LTC and LTV ratios are often calculated and considered together by lenders, and it’s uncommon for the LTC ratio to be used as the only underwriting criteria.

LTC is, however, more often used when underwriting loans that require large up-front capital costs and expenses like flips or new construction projects.

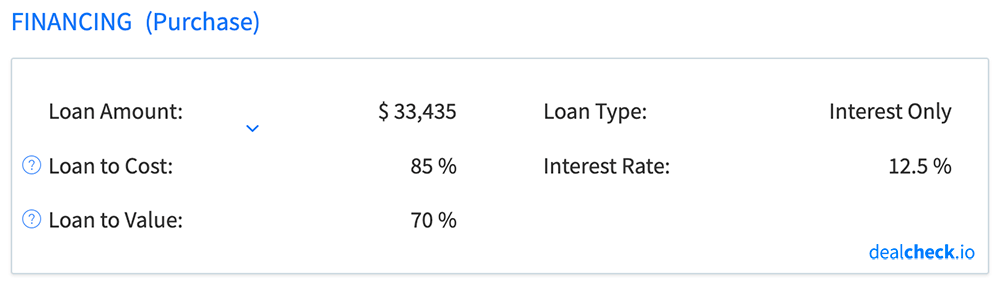

Calculate LTC and Dozens of Other Metrics in Seconds

The DealCheck property analysis app makes it easy to calculate the loan to cost ratio, along with dozens of other property analysis metrics for rental properties, BRRRR’s, flips, and rehab projects in seconds.

You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device.