The so-called 70% Rule is commonly used by real estate investors, house flippers and wholesalers as a quick rule of thumb to calculate offer prices on flips, BRRRR’s, wholesale deals, and other projects that require rehab work.

Although the rationale behind this rule is based on statistical data and the collective experience of many real estate investors, the 70% Rule does have some drawbacks that should be kept in mind when using it to make offers to sellers.

In many markets and situations, the percentage used in this rule’s formula needs to be adjusted either up or down, creating other variations of this rule, like the 65% Rule or the 75% Rule. The discussion of the 70% Rule below applies to its variations as well.

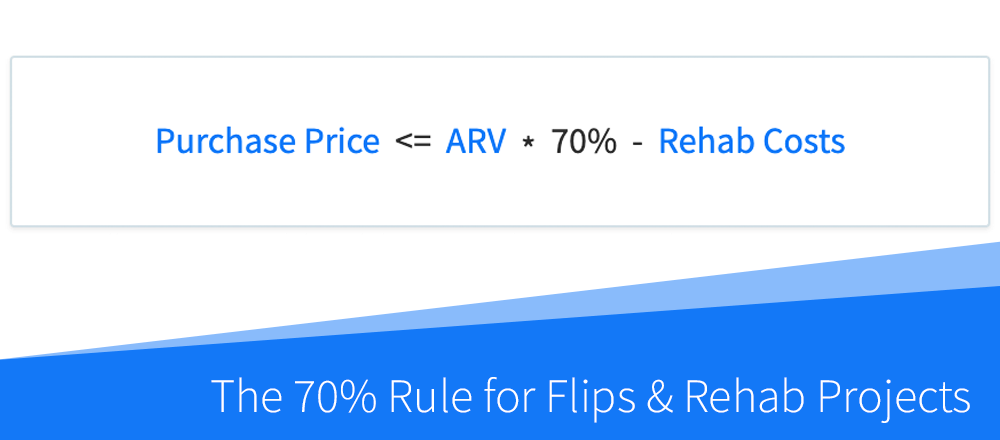

The 70% Rule Formula

The 70% Rule can be used to calculate a maximum allowable offer or purchase price an investor is willing to pay for a property using the following formula:

This formula states that the purchase price of a property should be less than or equal to 70% of its after repair value (ARV), minus the rehab costs. If using a variation of the 70% Rule, you can substitute your desired percentage in the formula above.

A property’s after repair value is an estimate of what its value or sale price will be after the rehab work is complete. Investors often look at sales comps and perform a comparative market analysis (CMA) to help them estimate ARVs. DealCheck can help you do this for any property in the US.

The rehab costs should include all expenses that will be paid to rehab the property, improve its condition or perform any necessary repairs or upgrades. Experienced investors will often estimate the rehab costs themselves, or get an estimate from a general contractor.

Using the 70% Rule to Make Offers to Sellers

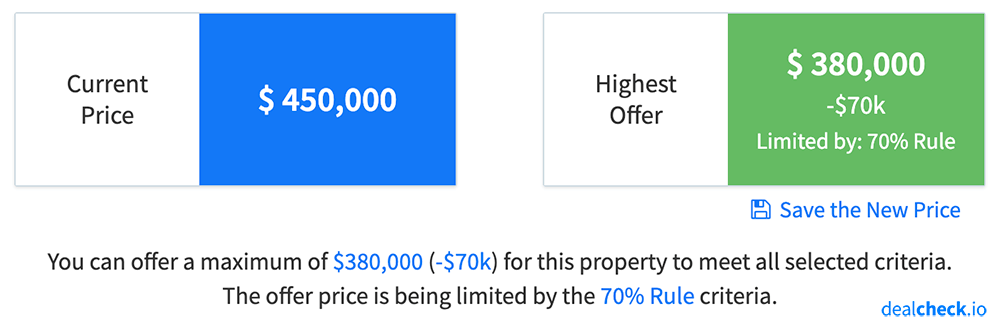

The primary use case of the 70% Rule is to quickly calculate the maximum purchase price when making offers to sellers on flips, BRRRR’s or other projects requiring substantial rehab work.

For example, consider a property with an estimated after repair value (ARV) of $350,000 and a projected rehab budget of $100,000. According to the 70% Rule, the maximum price an investor should pay for this house is calculated as $350,000 * 70% – $100,000 = $145,000.

An investor can then use this figure to make an offer to the seller for this amount, or attempt to negotiate with them for an even lower purchase price.

The Rationale Behind the 70% Rule

The 70% Rule aims to accomplish two things:

- Give investors, flippers or wholesalers a safety margin in case they have unforeseen expenses or rehab cost overruns

- Allow them to make a profit after rehabbing and selling a property, or have some starting equity if they keep it as a rental (as is done with BRRRR’s)

You can think of the 70% Rule as giving you a profit or operating margin that is built in to the transaction right at the time of property purchase.

As long as the ARV and the rehab costs were estimated correctly, that margin should (for the most part) become your profit after selling the property.

The Drawbacks of the 70% Rule

While the 70% Rule is widely used, it does have some drawbacks that are important to keep in mind, especially if you are a new investor without a lot of experience.

The first drawback is that it relies on having an accurate after repair value (ARV) estimate for each property. If the ARV is over-estimated, the 70% Rule will cause you to overpay for properties and potentially lose money on those projects. To counteract this, it is important to develop a system for estimating ARV as accurately as possible.

Similar to the above, the 70% Rule requires an accurate estimate of the rehab costs. New and inexperienced investors may underestimate the rehab costs on their first few projects. It may also be difficult to come up with an estimate if you don’t have access to a property or don’t know its exact condition. It is often helpful to work with a general contractor who can help you estimate the rehab costs before making offers.

And finally, because the 70% Rule uses a percentage, the actual profit or operating margin as a dollar amount will vary greatly depending on the ARV range of the property. This rule may work great for properties worth $500,000 or more, but it may need to be adjusted if you’re rehabbing lower-cost homes, as discussed below.

Here are some things you can do to work around these drawbacks:

- Calculate your projected profit as a dollar amount and determine if it will be acceptable

- Take your time to estimate ARVs as accurately as possible. Use DealCheck to help you look up sales comps for your properties

- Add a “cost overrun” amount (for example, 10%) on top of your rehab costs for an additional safety margin

- Consider using a variation of the 70% Rule as discussed below

Variations of the 70% Rule

As mentioned earlier, it is common for investors to adjust the percentage used in this rule’s formula up or down to meet their specific profit margin goals, or to be more competitive in their local market.

Below are some example scenarios when you may consider lowering or raising the percentage used by this rule:

When to Lower the 70% Percentage

The lower the rule’s percentage, the more restrictive it becomes when calculating offer prices, which may make your offers less competitive against other buyers. However, this will increase your potential profit and give you an additional buffer for unforeseen expenses.

Consider lowering the percentage down from 70% when:

- The market you operate in is not very competitive, so it’s less likely another investor will outbid you

- You are purchasing cheaper homes (less than $100,000 in value, for example). At lower price points you may need a larger percentage margin for your profit

- You are not confident in your ARV or rehab cost estimates and would like a larger safety margin

When to Raise the 70% Percentage

The higher the rule’s percentage, the higher the purchase price values it will calculate for you, making your offers more competitive against other bidders. However, higher percentages will lower your potential profit and safety margin.

Consider raising the percentage up from 70% when:

- You operate in a highly competitive market where properties receive multiple competing offers

- You are rehabbing higher-value homes, so a lower margin will still give you enough profit and safety margin

- You are confident in your ARV and rehab cost estimates, making the 70% Rule calculation more accurate

Calculate the 70% Rule and Dozens of Other Metrics in Seconds

The DealCheck property analysis app makes it easy to calculate and use the 70% Rule, along with dozens of other property analysis metrics for flips, BRRRR’s and rehab projects in seconds.

You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device.