The so-called 50% Rule is commonly used by real estate investors as a quick rule of thumb to estimate rental property expenses, as well as occasionally used as investment criteria when evaluating rental properties.

Although the rationale behind this rule is based on statistical data and the collective experience of many real estate investors, the 50% Rule has significant drawbacks that make it unsuitable to use as the primary operating expense calculation method or the exclusive purchase criteria.

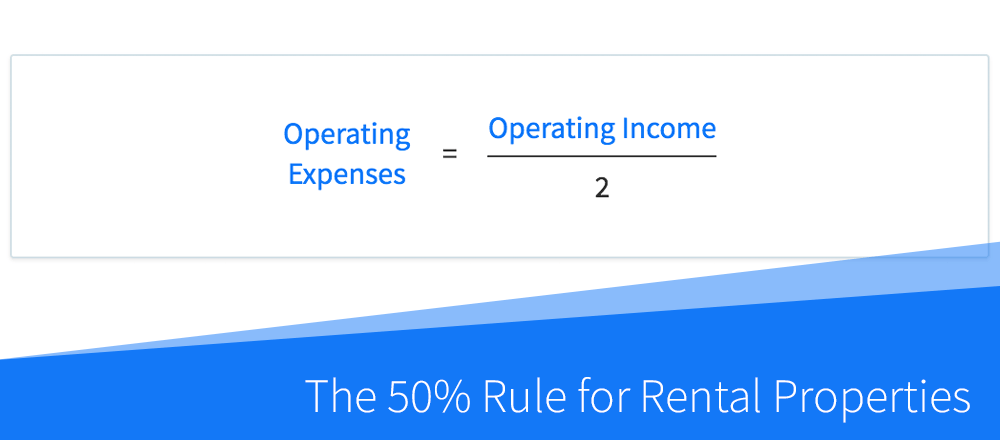

The 50% Rule Formula

When using the 50% Rule to estimate the operating expenses of a rental property (expenses that do not include the loan payments), simply take the expected operating income of a property and divide it by two:

In the formula above, the operating income can be calculated by taking the expected gross rent, adding any miscellaneous income to it, and subtracting the vacancy allowance.

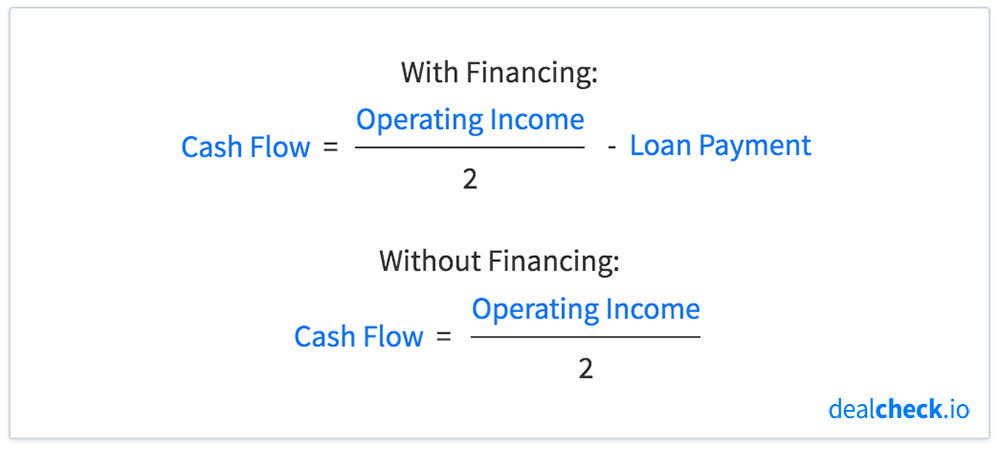

The above formula can be further expanded to use the 50% Rule to calculate the potential cash flow of a rental property:

Using the 50% Rule to Estimate Operating Expenses

The most common use of the 50% Rule is to quickly estimate operating expenses, net operating income (NOI), and the cash flow of a rental property using the formulas shown above.

This rough “back-of-the-napkin” cash flow calculation method has become popular among investors during the initial property evaluation to see if it will produce positive cash flow and is worth investigating further.

Even though this method is commonly used, it is important to keep in mind that it produces extremely rough, and potentially misleading, cash flow estimates.

While the operating expenses of many rental properties may indeed be around 50% of their operating income, there is a wide range of possible outcomes and the estimated expenses calculated with the 50% Rule may be significantly lower or higher than the actual expenses of the property.

If you are serious about buying a particular property, we strongly believe that you should forgo the use of this rule and instead research and use the actual itemized operating expenses you expect to have, such as:

- Property taxes

- Property insurance

- Property management and leasing fees

- Maintenance and repair expenses

- Capital expenditures

- Accounting and legal fees

- Utilities (when applicable)

- HOA fees (when applicable)

- Landscaping (when applicable)

The net operating income and cash flow projections produced using the actual itemized expense values are going to be much more accurate and realistic than solely relying on the 50% Rule to estimate all expenses.

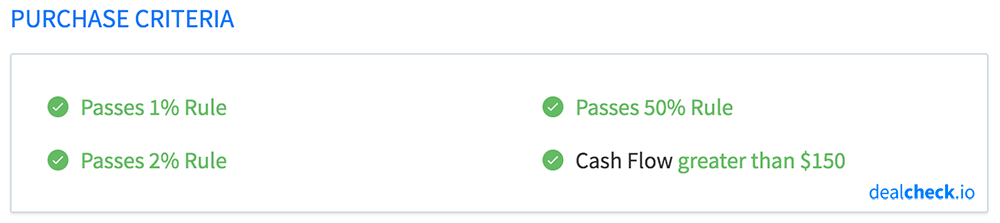

Using the 50% Rule as a Purchase Criteria

Some investors may use the 50% Rule as part of their purchase criteria for rental properties, even though they may not use it to estimate potential cash flow.

In this case, the 50% Rule is used to filter out investment properties that have excessively high expenses relative to their potential rents. In other words, properties where the operating expense are greater than 50% of the operating income.

Using the 50% Rule as purchase criteria can help you avoid areas with high vacancies or high property taxes, as well as specific properties with increased maintenance costs or capital expenditures.

As with other purchase criteria, just because a property doesn’t meet the 50% Rule, does not automatically mean that it’s not a suitable investment. But it may cause you to reconsider buying it, or at least investigate why the projected expenses are so high.

Calculate the 50% Rule and Dozens of Other Metrics in Seconds

The DealCheck property analysis app makes it easy to calculate and use the 50% Rule, along with dozens of other property analysis metrics for both commercial and residential rental properties in seconds.

You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device.