The capitalization rate, commonly referred to simply as the cap rate, is a popular rate of return that is used when evaluating and comparing rental properties, especially when working with commercial real estate.

Calculated by dividing a property’s net operating income (NOI) by its market value, the cap rate seeks to estimate the return of a real estate investment, while not accounting for the cost of financing used to purchase it.

It can also be used as a valuation tool to determine a property’s current market value, given its net operating income and an average cap rate of similar properties.

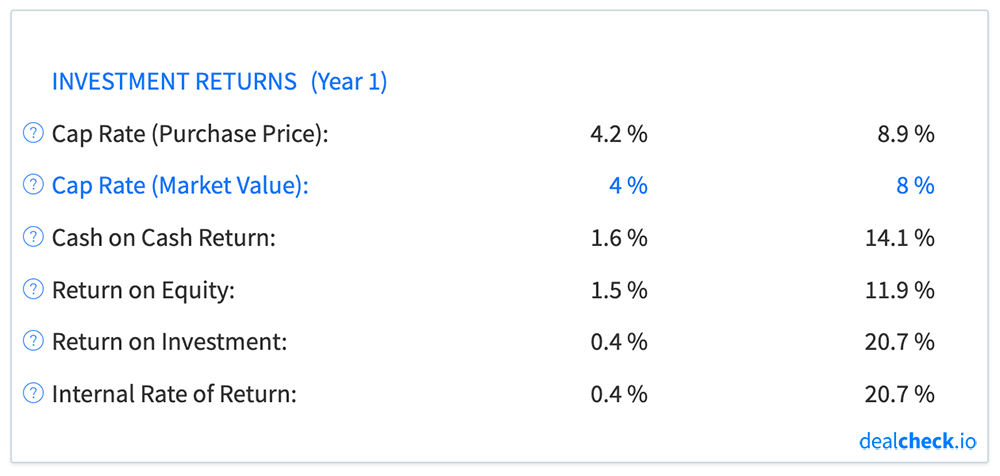

While the cap rate is widely used, it is not without limitations, and should not be used as the only metric when evaluating potential rental properties. Other rates of return, like the cash on cash return (COC), return on investment (ROI), and the internal rate of return (IRR) offer a more complete picture of a property’s potential performance.

The Capitalization Rate (Cap Rate) Formula

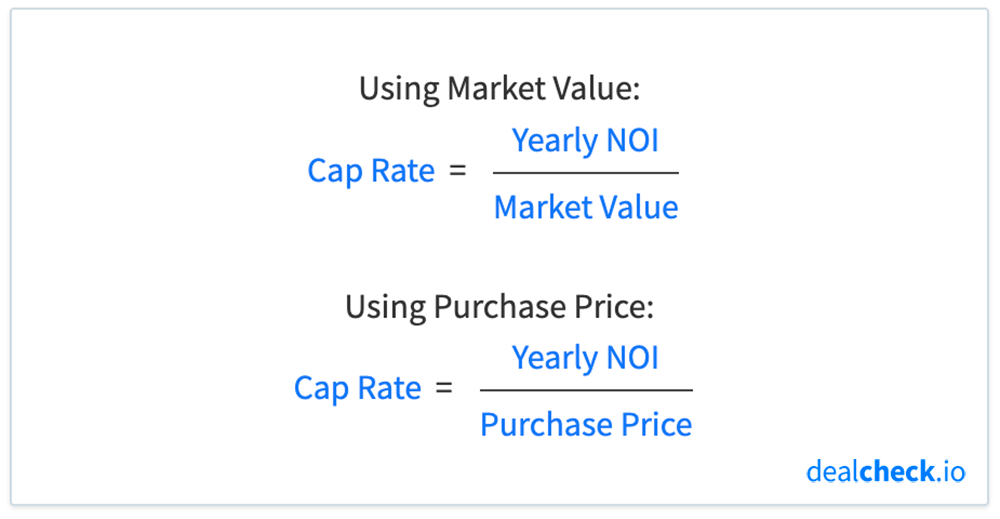

The cap rate can be calculated by dividing a property’s yearly net operating income (NOI) by its current market value, or sometimes the purchase price. It is expressed as a percentage:

The net operating income of a property can be calculated by subtracting the vacancy and all operating expenses (excluding loan payments) from the property’s gross rent. It is the net profit a property will generate before accounting for the cost of financing.

While the traditional cap rate formula uses a property’s current appraised or market value in the denominator, many investors use a property’s purchase price when calculating cap rates for potential new investments.

Using Cap Rates to Compare Investment Properties

The main use of cap rates among real estate investors is to compare potential un-levered (not taking into account financing) returns of residential or commercial rental properties.

If Property A has a yearly net operating income of $10,000 and is valued at $250,000, its cap rate can be calculated as $10,000 / $250,000 = 4.0%.

We can compare this to Property B, which has a yearly NOI of $8,000 and a market value of $100,000. Its cap rate would be $8,000 / $100,000 = 8.0%, double that of Property A.

So, what can we learn from comparing the two cap rates? Not taking into account any other factors, Property B, with a cap rate of 8%, would give a higher rate of return relative to its market value than Property A. The higher the cap rate of a property, the higher the potential return it can generate.

At the same time, a cap rate can also be viewed as a measure of investment risk. Properties with higher cap rates generally have lower values than properties with lower cap rates, which is usually due to increased risks associated with owning and operating them.

For example, properties in more distressed or rural areas may have higher cap rates (due to lower property values), but may have more issues with long vacancies, tenant delinquencies, and unforeseen maintenance costs for the landlord.

Because of this, it’s often in the investor’s best interest to not simply focus on finding a property with the highest cap rate, but also to find a property investment within the investor’s risk tolerance and the ability to manage it effectively.

What is a Good Cap Rate?

Cap rates vary greatly between different geographical markets and property types, so it is not possible to give a general recommendation for a minimum (or maximum) cap rate a property should have.

Furthermore, as mentioned above, cap rates are a measure of risk, and risk tolerances vary among different investors. It is important to consider your specific risk tolerance and not just the property’s cap rate value.

With that being said, most rental investors target properties with a cap rate of 4-8%. Properties with a cap rate of less than 4% may be in great areas, but their returns are typically sub-par relative to their high values. On the other hand, properties with cap rates above 8% can have high cash flow, but are usually more risky and management-intensive.

When looking at rental properties and rental markets, it is also helpful to view historical cap rate trends, and not just focus on what the cap rates are now. As property values tend to be more volatile than rents, cap rate trends can be helpful in determining the direction a market is headed.

For example, if cap rates are trending down in a specific market, it can be an indication that the property values are going up and the market is getting saturated with investors and homebuyers. On the other hand, increasing cap rates may indicate that the property values are dropping due to declining demand and worsening economic conditions in that market.

Using the Cap Rate as a Valuation Tool

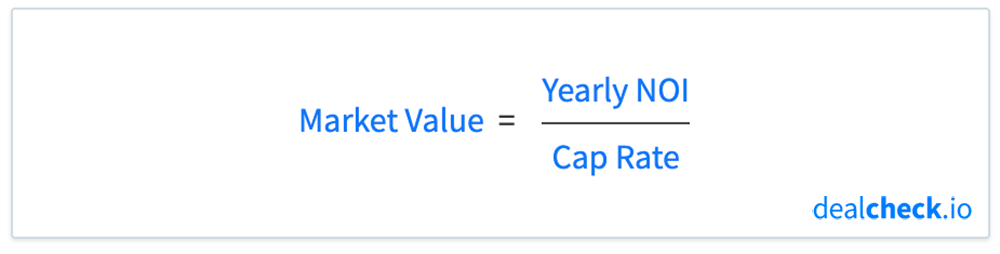

The capitalization rate can also be used in a process called reverse valuation, by solving the cap rate formula above for a property’s market value instead:

In other words, given a property’s NOI and its expected cap rate, you can determine the property’s current market value to help you determine the maximum offer price you would be willing to offer to the seller, and prevent overpaying for rental properties.

To obtain a property’s expected cap rate, you can look at recent comparable sales of similar properties in the same market. Given their net operating income and sold prices, you can calculate the cap rate of each comparable, and then average them out to find the expected cap rate for the type of property that you’re evaluating.

This reverse valuation method is especially popular in commercial real estate, where property values are largely determined by their operating performance (NOI), rather than homebuyer demand.

The Limitations of Cap Rates

While the cap rate is a helpful metric, it is not without limitations, and therefore should not be used as the only criteria when evaluating and comparing rental properties. Some investors choose not to rely on the cap rate at all, preferring other measures of return instead.

The first limitation of a cap rate is that it does not take into account the loan payments, so it ignores the cost and terms of financing used to purchase a property. While this is not an issue for cash purchases, most investors use some form of financing and leverage, which can have a significant impact on the actual rate of return they will achieve. The COC, ROI and IRR metrics do take financing into account and are better suited for calculating total returns.

The cap rate is also a static metric, which only shows the current (or the potential) return at a given point in time. It does not take into account the time value of money, or how future improvements or renovations may affect a property’s return. Use the IRR metric instead when considering the time value of money.

The last point to consider about cap rates is that they can be volatile and subject to manipulation. On the denominator side of their equation, cap rates can be significantly skewed by property values, which can rapidly rise or fall during certain market shifts, increasing or decreasing cap rates with them. On the numerator side, a property’s NOI can be arbitrarily inflated by under accounting for the vacancy or capital expenditures, once again distorting the cap rate.

Calculate Cap Rates and Dozens of Other Metrics in Seconds

The DealCheck property analysis app makes it easy to calculate the cap rates, along with dozens of other property analysis metrics for rental properties, BRRRR’s and commercial properties in seconds.

You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device.