DealCheck Blog

Strategies & tips for becoming a better real estate investor.

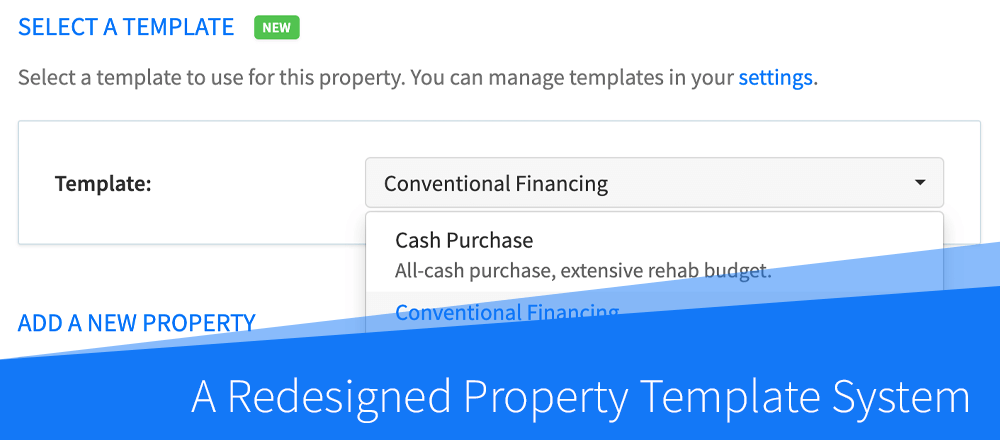

New Feature: A Redesigned Property Template System

We are very excited to let you know about a new flexible property template system we've just added! Property templates replace our old "presets" and are designed to help you quickly analyze new deals with different strategies, locations, and categories. Here is how...

New: Free Resources for Real Estate Investors

We've just published a collection of free resources for real estate investors, including checklists, interview questions, and our glossary reference! All of these are available 100% for free and you can view the full list on our website. Here are some quick links to...

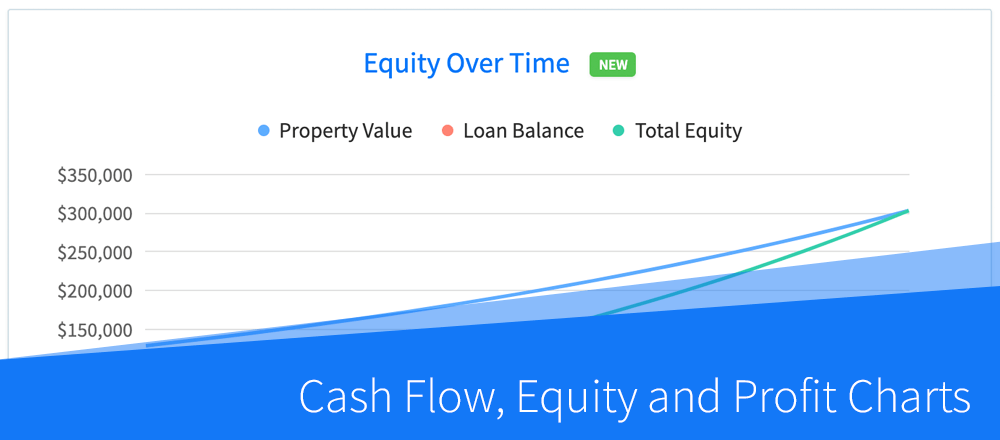

New Feature: Cash Flow, Equity and Profit Charts

Check out what's new in our latest update, including projection charts, more detailed loan analysis, and a new way to integrate DealCheck with other apps: Cash Flow and Profit Projection Charts You can now view cash flow and equity projection charts for all rentals...

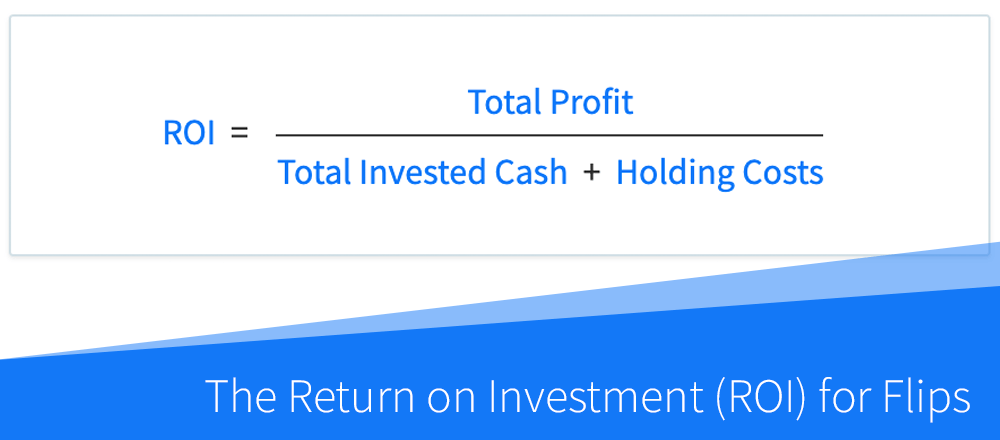

How to Calculate the Return on Investment (ROI) for Flips and Rehab Projects

Note: This article describes the ROI calculation specifically for flips and rehab projects, and not rental properties, which is calculated differently. The return on investment, abbreviated as ROI, is a primary measure of investment return used by investors when...

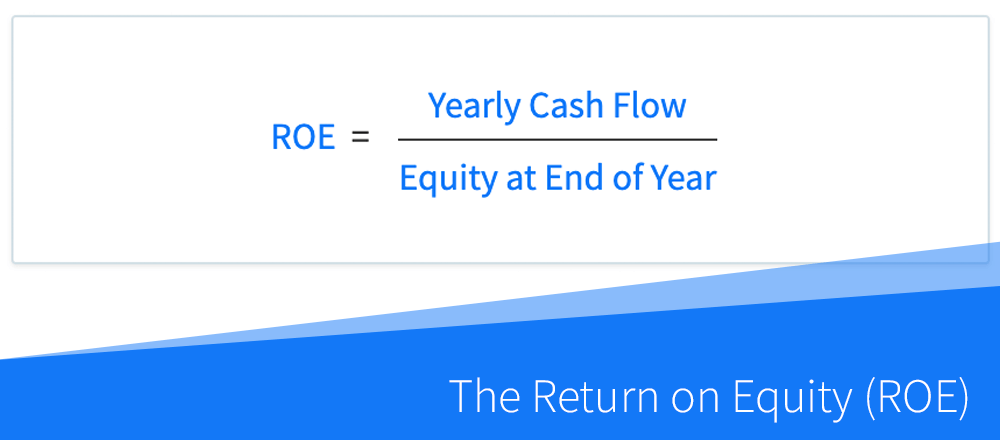

How to Calculate and Use the Return on Equity (ROE) in Real Estate

The return on equity, abbreviated as ROE, is a measure of investment return that can be used to evaluate and compare rental properties, as well as assess their future performance. The ROE is similar to the cash on cash return (COC), but instead of using the initial...

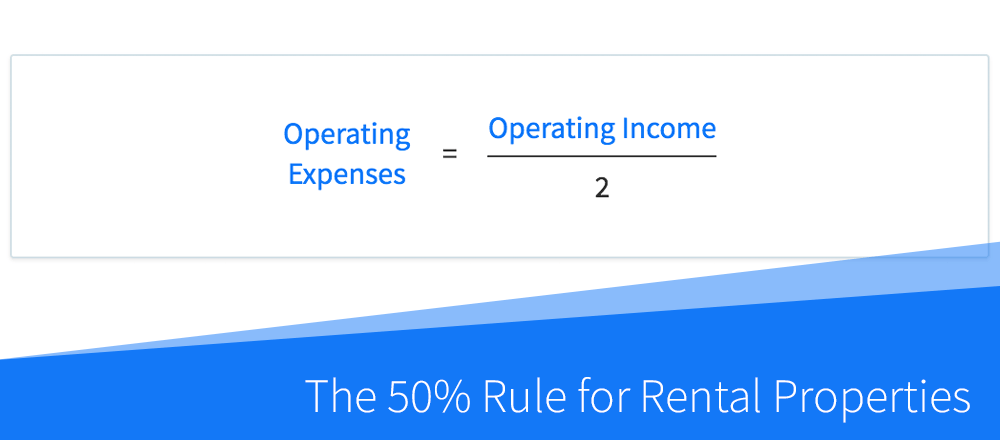

What Is the 50% Rule in Real Estate and How Is It Useful to Investors?

The so-called 50% Rule is commonly used by real estate investors as a quick rule of thumb to estimate rental property expenses, as well as occasionally used as investment criteria when evaluating rental properties. Although the rationale behind this rule is based on...

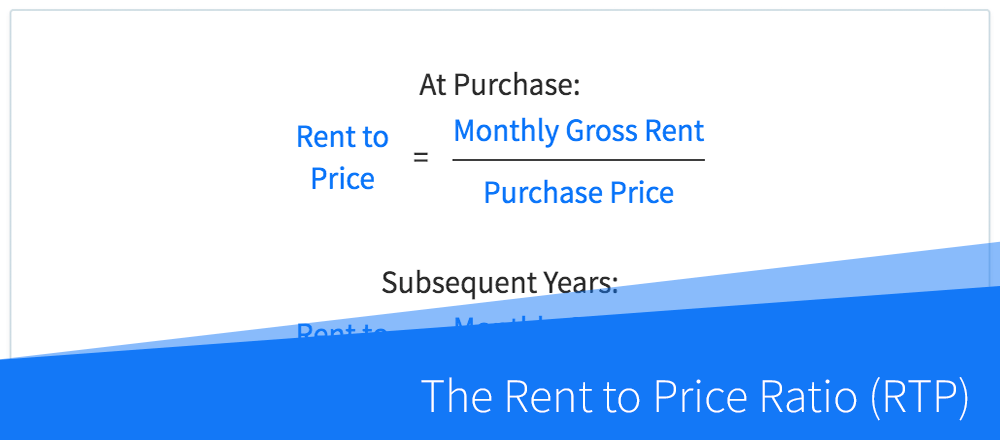

How to Calculate the Rent to Price Ratio (RTP) in Real Estate

The rent to price ratio (RTP), also called the rent to value ratio (RTV), is often used by rental property investors when evaluating potential rental markets and specific investment properties. This ratio can be used as a quick indicator to determine whether a...

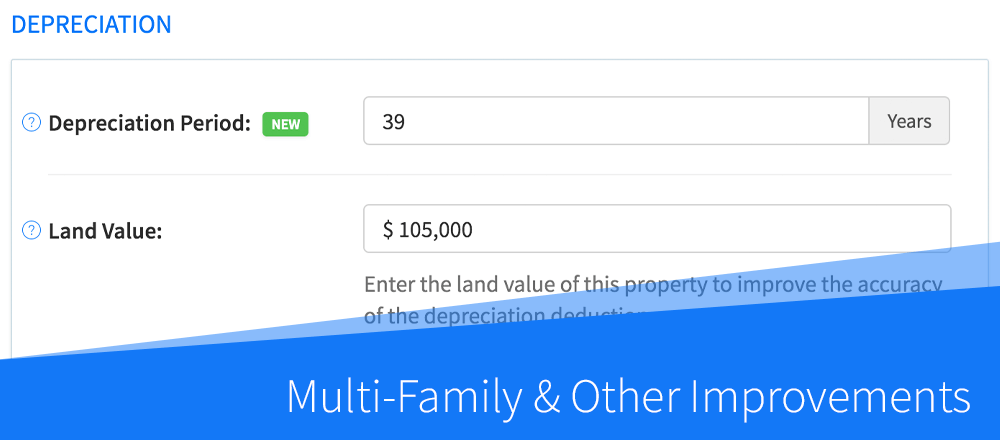

New Features: Multi-Family & Other Platform Improvements

Our latest update added the ability to import rent rolls for multi-family properties, adjust depreciation periods, add properties to RentCast and more! Check out the highlights below: Property Data Import Improvements When importing data for multi-family or commercial...

Meet RentCast – Our New Platform for Growing & Tracking Your Rental Portfolio

After many months of hard work, we're extremely excited to share our new platform in the DealCheck family - RentCast. We built RentCast to help rental property investors, landlords and property managers grow and track their rental portfolios with these key features:...

Happy New Year! Thank You for Your Support, Feedback and Suggestions

2020 may not have been the year we all hoped for, but that didn't stop you from showing your support for DealCheck every step of the way! We truly appreciate all of the feedback and suggestions we have received, and thank you for sharing our app with so many of your...