DealCheck Blog

Strategies & tips for becoming a better real estate investor.

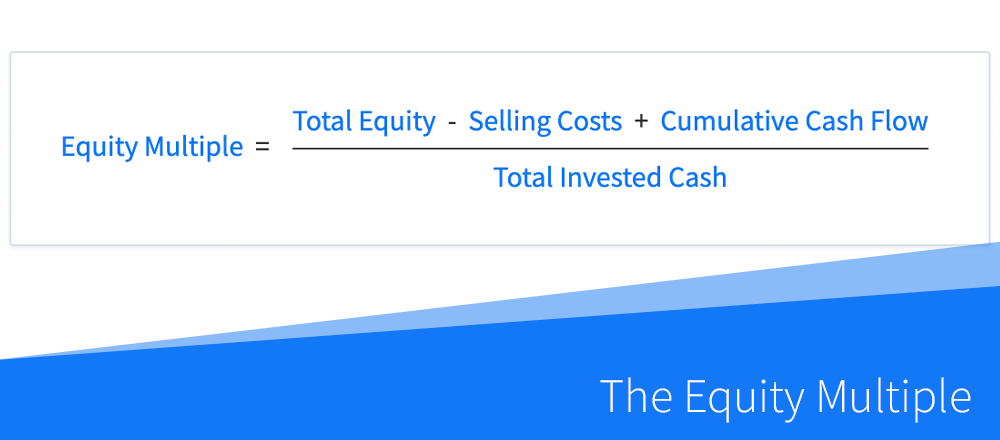

What Is the Equity Multiple in Real Estate and How Is It Calculated?

The equity multiple is a measure of profitability and investment return commonly used by commercial real estate investors, although it can be used as a performance metric when analyzing and comparing any rental property or BRRRR. Equity multiple takes into account the...

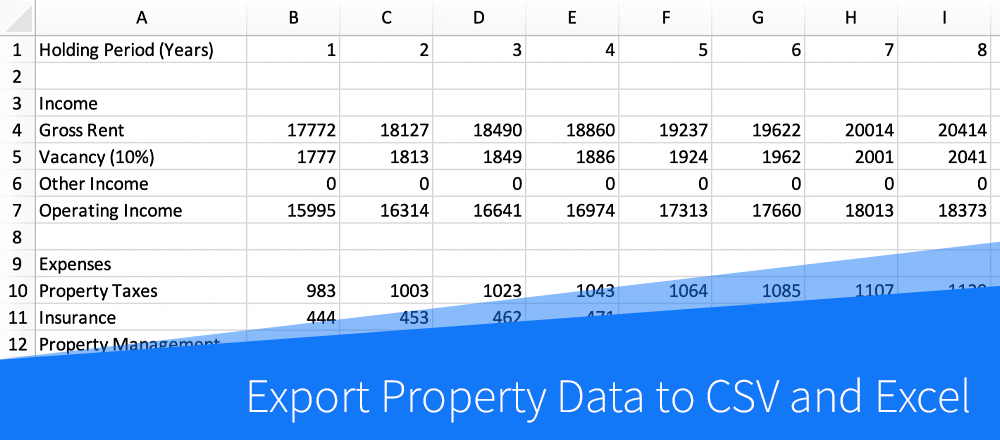

New Feature: Export Property Data to CSV and Excel

Our first big update of 2022 added the ability to export property data to CSV and Excel, improved the 70% Rule criteria for flips, and added more options to customize your rental property analysis. Check out the highlights below: Export Data to CSV and Excel You can...

Happy New Year! Highlights From 2021 and Looking Ahead

We've had a great year here at DealCheck and hope you did as well! Here are the highlights of what we've accomplished in 2021, as well as some of the things we are working on in the future. Features We’ve Recently Added As always, we have continued to improve our...

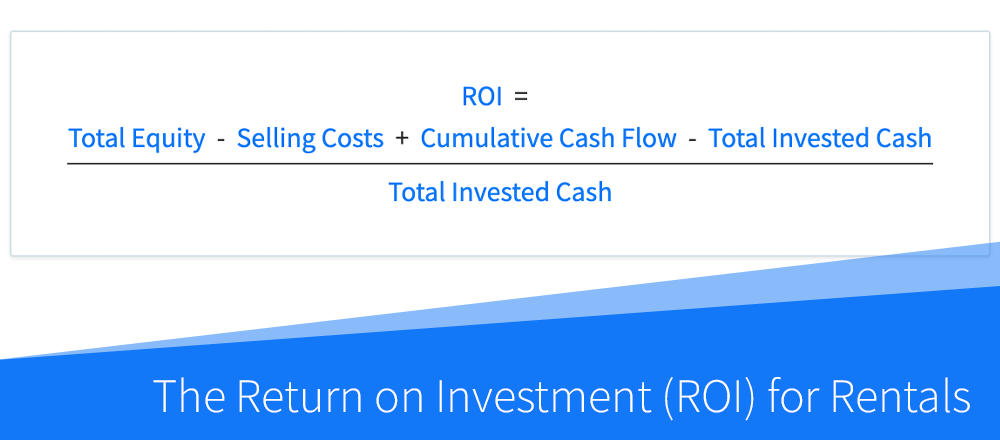

How to Calculate the Return on Investment (ROI) for Rental Properties

Note: This article describes the ROI calculation specifically for rental properties, and not flips and rehab projects, which is calculated differently. The return on investment, abbreviated as ROI, is one of the primary metrics of profitability and a measure of the...

How to Calculate the Debt Yield in Commercial Real Estate

The debt yield is an indicator of leverage and loan risk that is often used by real estate lenders when underwriting loans for rental properties, especially when working with commercial real estate. In simple terms, debt yield can be used to estimate how long it will...

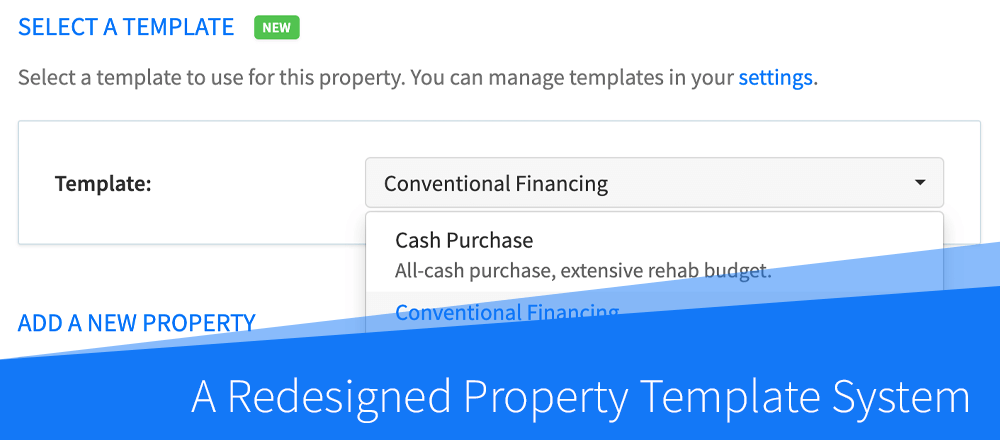

New Feature: A Redesigned Property Template System

We are very excited to let you know about a new flexible property template system we've just added! Property templates replace our old "presets" and are designed to help you quickly analyze new deals with different strategies, locations, and categories. Here is how...

New: Free Resources for Real Estate Investors

We've just published a collection of free resources for real estate investors, including checklists, interview questions, and our glossary reference! All of these are available 100% for free and you can view the full list on our website. Here are some quick links to...

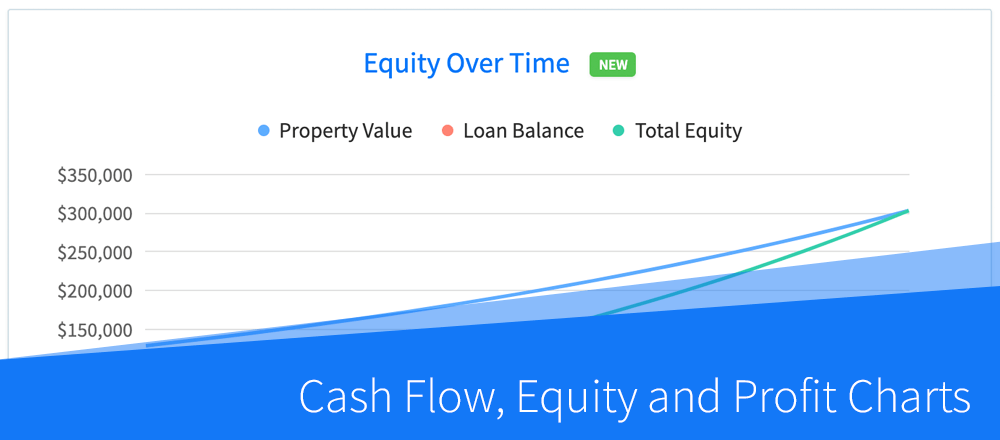

New Feature: Cash Flow, Equity and Profit Charts

Check out what's new in our latest update, including projection charts, more detailed loan analysis, and a new way to integrate DealCheck with other apps: Cash Flow and Profit Projection Charts You can now view cash flow and equity projection charts for all rentals...

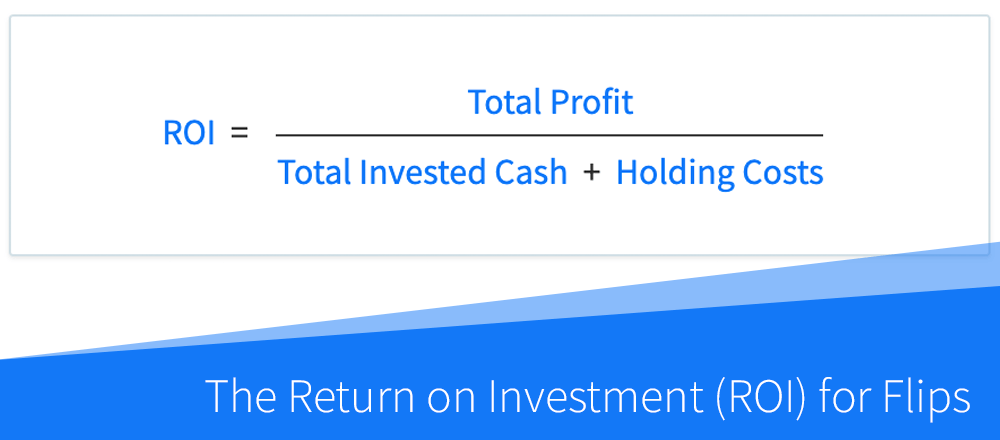

How to Calculate the Return on Investment (ROI) for Flips and Rehab Projects

Note: This article describes the ROI calculation specifically for flips and rehab projects, and not rental properties, which is calculated differently. The return on investment, abbreviated as ROI, is a primary measure of investment return used by investors when...

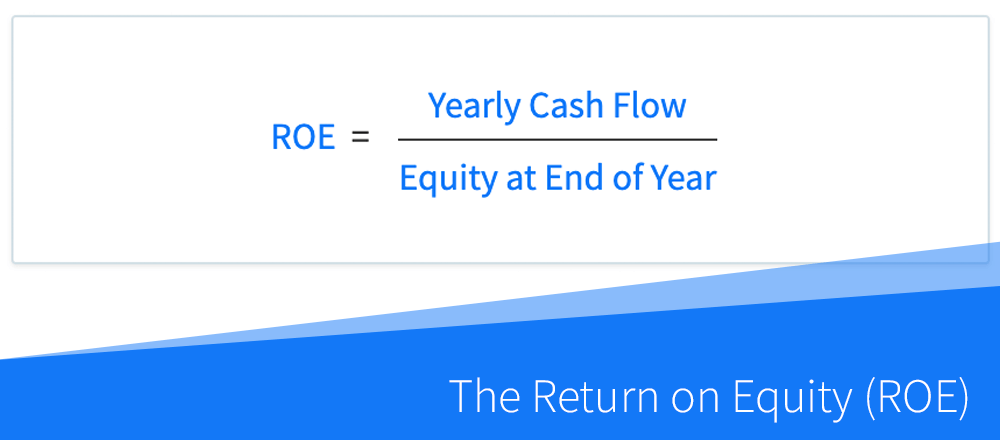

How to Calculate and Use the Return on Equity (ROE) in Real Estate

The return on equity, abbreviated as ROE, is a measure of investment return that can be used to evaluate and compare rental properties, as well as assess their future performance. The ROE is similar to the cash on cash return (COC), but instead of using the initial...