DealCheck Blog

Strategies & tips for becoming a better real estate investor.

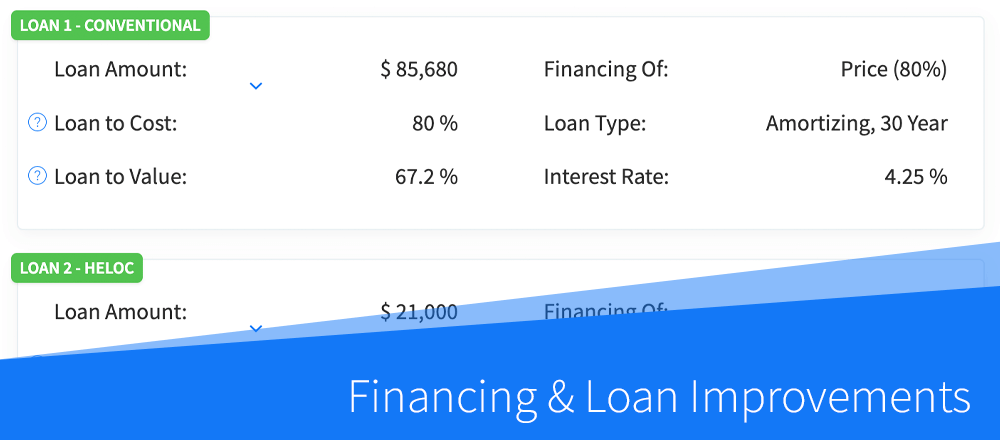

New Features: Financing and Loan Improvements

We are super excited to share the highlights of our latest update, which added many highly requested financing and loan features to DealCheck! With these new improvements, you should be able to analyze many more creative financing and loan strategies with our analysis...

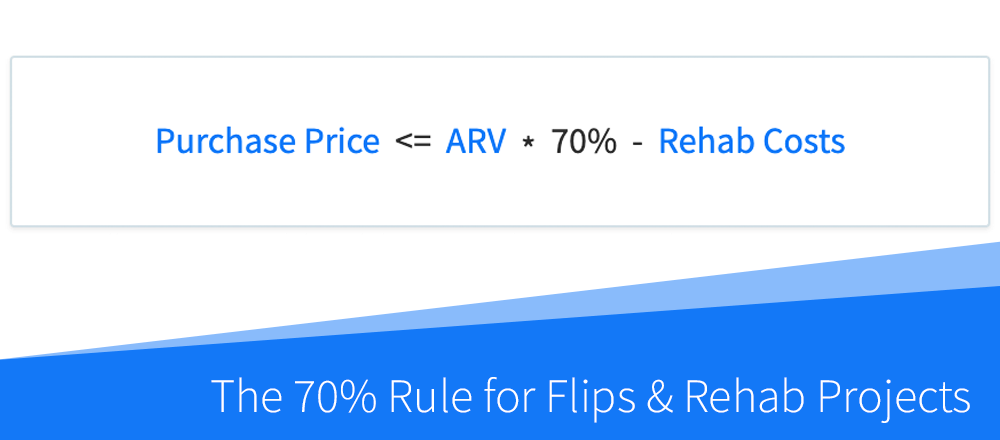

What Is the 70% Rule in Real Estate and How Is It Useful When Making Offers?

The so-called 70% Rule is commonly used by real estate investors, house flippers and wholesalers as a quick rule of thumb to calculate offer prices on flips, BRRRR's, wholesale deals, and other projects that require rehab work. Although the rationale behind this rule...

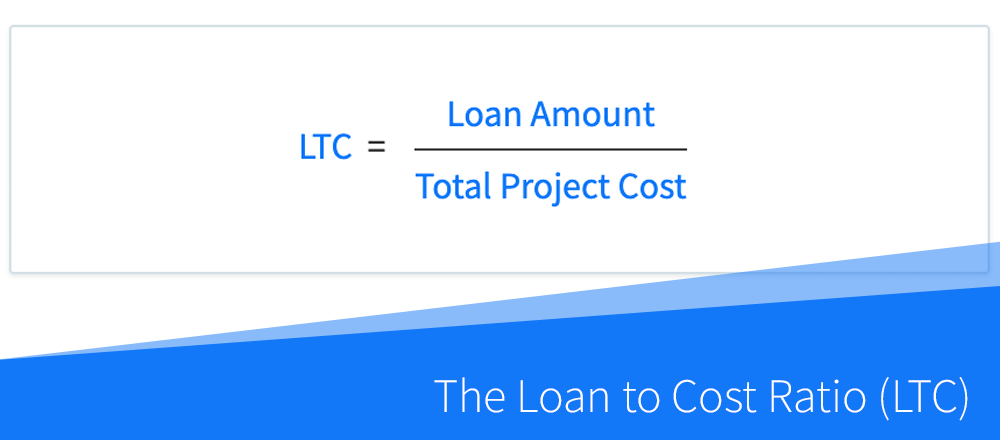

What Is the Loan to Cost Ratio (LTC) And How Is It Used by Lenders?

The loan to cost ratio (LTC) is often used by hard money and commercial real estate lenders when underwriting loans for flips, BRRRR's and new construction projects. Simply put, it shows the percentage of a project's total cost that is financed by the lender. For...

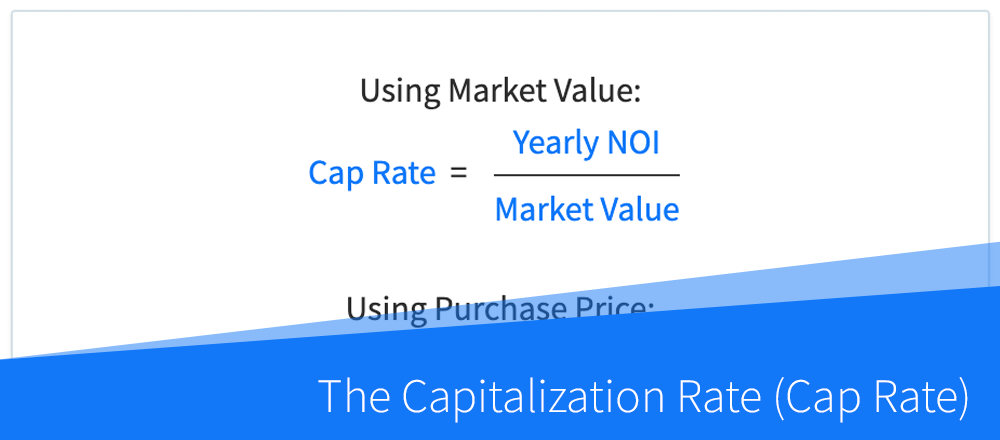

Understanding the Capitalization Rate (Cap Rate) for Rental Properties

The capitalization rate, commonly referred to simply as the cap rate, is a popular rate of return that is used when evaluating and comparing rental properties, especially when working with commercial real estate. Calculated by dividing a property's net operating...

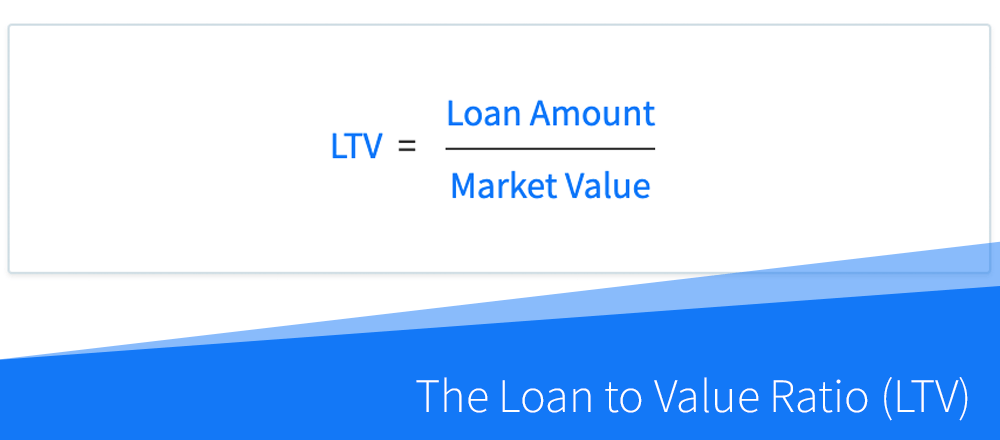

What Is the Loan to Value Ratio (LTV) And How Is It Used by Lenders?

The loan to value ratio (LTV) is one of the primary metrics used by real estate lenders when underwriting loans for rental properties, BRRRR's and flips. Simply put, it shows the percentage of a property's value that is taken up by the loan amount. For lenders, it is...

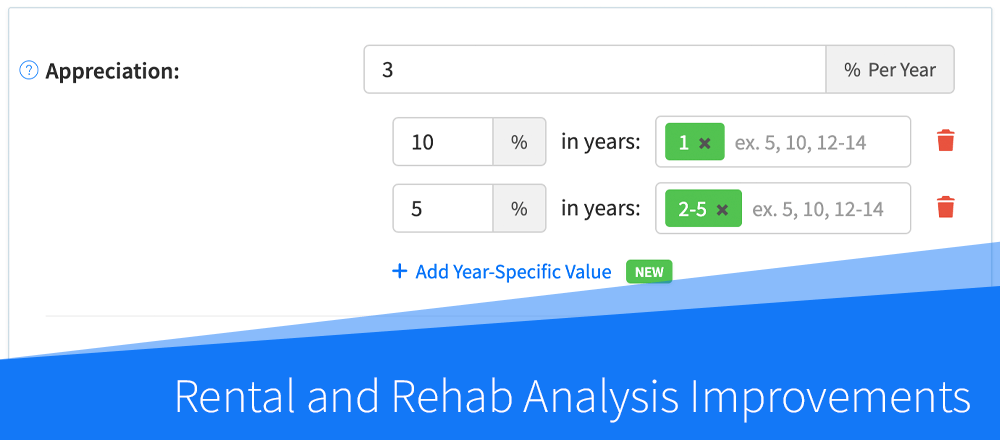

New Features: Rental and Rehab Analysis Improvements

In our latest update, we made several improvements to our rental and rehab analysis tools to help you analyze more complex rental projection scenarios, and quickly create reusable rehab templates. Here is everything we've added: Analyze Advanced Rental Projection...

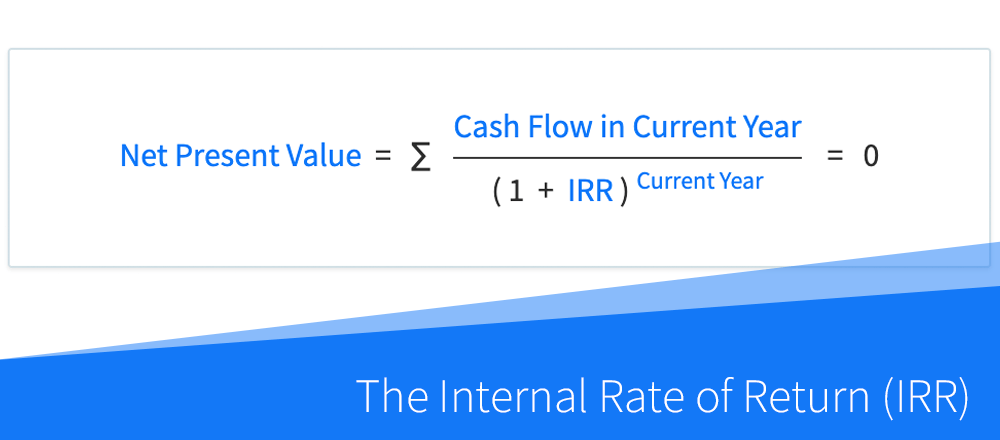

How to Calculate the Internal Rate of Return (IRR) for Rental Properties

Note: This article describes the IRR calculation for rental properties. To learn about the annualized ROI for flips and rehab projects, read this article instead. The internal rate of return, abbreviated as IRR, is a widely used metric of profitability and a measure...

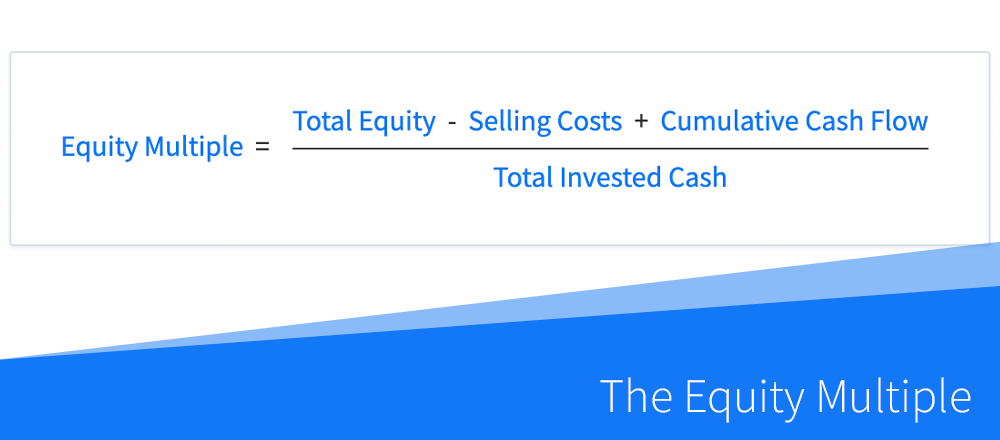

What Is the Equity Multiple in Real Estate and How Is It Calculated?

The equity multiple is a measure of profitability and investment return commonly used by commercial real estate investors, although it can be used as a performance metric when analyzing and comparing any rental property or BRRRR. Equity multiple takes into account the...

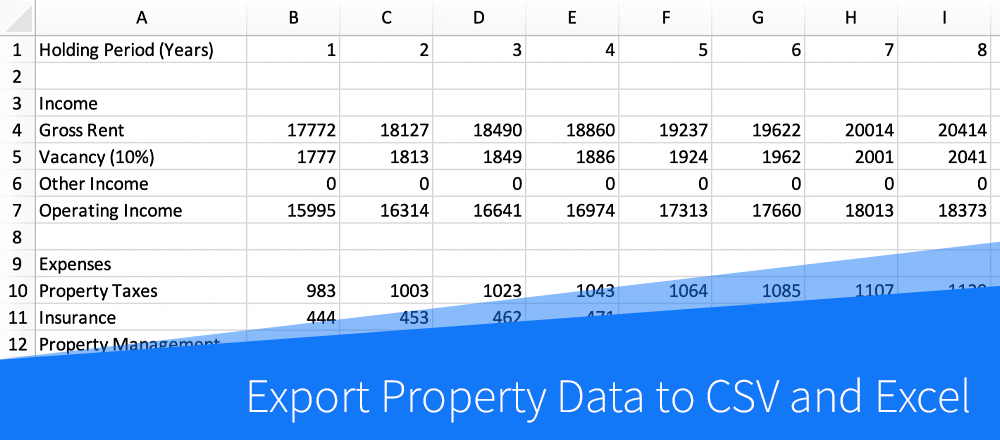

New Feature: Export Property Data to CSV and Excel

Our first big update of 2022 added the ability to export property data to CSV and Excel, improved the 70% Rule criteria for flips, and added more options to customize your rental property analysis. Check out the highlights below: Export Data to CSV and Excel You can...

Happy New Year! Highlights From 2021 and Looking Ahead

We've had a great year here at DealCheck and hope you did as well! Here are the highlights of what we've accomplished in 2021, as well as some of the things we are working on in the future. Features We’ve Recently Added As always, we have continued to improve our...