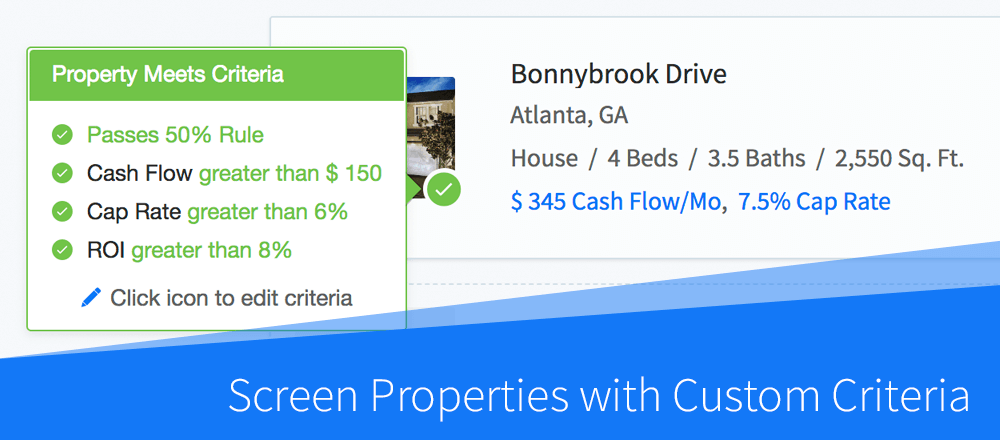

We’ve just revamped our purchase criteria analysis feature to help you quickly screen deals and find properties that are worth buying.

Here are the highlights of the improvements:

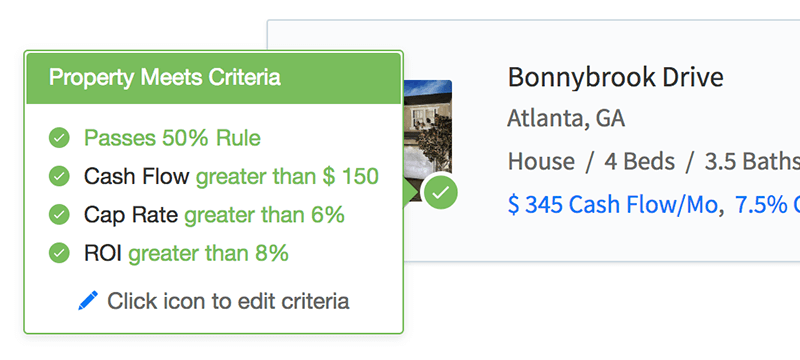

Hover Over the “Checkmark” and “X” Icons to View Criteria Analysis

You can hover over (online) or tap (on mobile) on the green checkmark and red x’s next to each property to view the purchase criteria analysis for that property.

A ✓ means the property met all of your criteria, while an ❌ means it didn’t meet some of it:

TIP: You can also view the list of passed and failed criteria on the Analysis Summary page for each property.

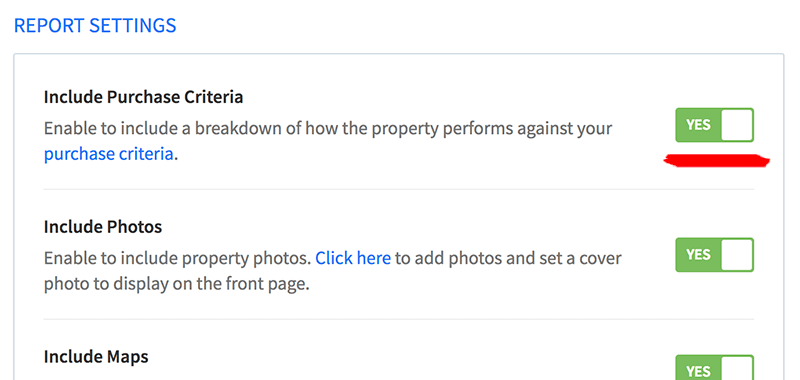

Include Purchase Criteria Analysis in PDF Reports

You can include a breakdown of how each property performed against your purchase criteria in its PDF report.

Enable this feature in the Report Settings:

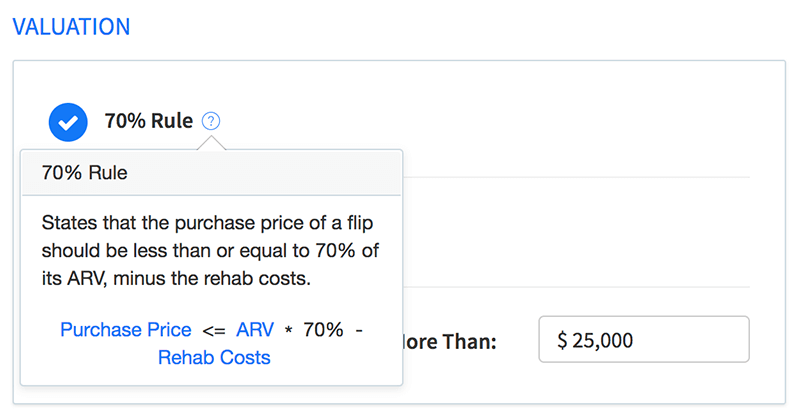

We’ve Added 2 New Criteria for Rentals & Flips

You can use Cash Flow Per Unit as a screening criteria for multi-family and commercial rental properties.

We’ve also added the 70% Rule for flips, which is a common criteria that states that the purchase price of a property should be less than 70% of its ARV, minus the rehab costs:

You can customize your purchase criteria separately for rentals and flips and choose from over a dozen metrics that are important to you. Try it now:

Have a suggestion? Send us a message if you’d like to see your feature request included in our next update.