The 1% Rule and 2% Rule are often used by real estate investors as purchase and investment criteria when evaluating rental properties and BRRRR’s prior to their purchase.

They can also be used as general valuation criteria when comparing the affordability of investment real estate across different states, cities, and markets.

Although commonly used, these rules are somewhat arbitrary and do not account for many important factors, such as rehab costs, operating expenses, and financing. That’s why it’s important to consider other property analysis metrics and not rely solely on these rules when making investment decisions.

What Is the 1% Rule in Real Estate?

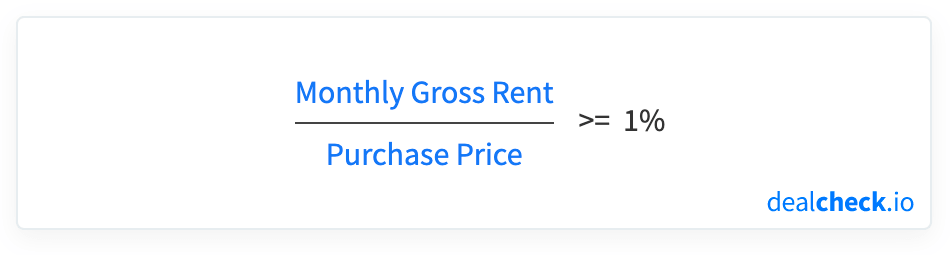

According to the 1% Rule, the rent to price ratio (RTP) of a rental property should be 1% or higher. In other words, the monthly gross rent of a property divided by its purchase price should equal to or be higher than 1%:

You can also phrase this rule another way – the monthly rental income of a property should be equal to or greater than 1% of its purchase price.

To check if a particular market or geographical area meets the 1% Rule, you can use the median monthly gross rent of a particular property type, divided by the median sale price of those properties.

What Is the 2% Rule in Real Estate?

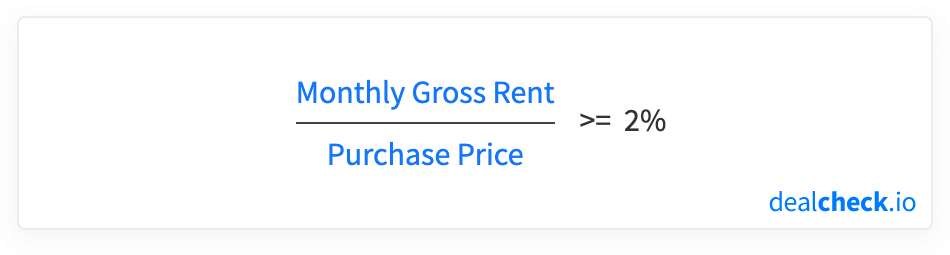

According to the 2% Rule, the rent to price ratio (RTP) of a rental property should be 2% or higher. In other words, the monthly gross rent of a property divided by its purchase price should equal to or be higher than 2%:

You can also phrase this rule another way – the monthly rental income of a property should be equal to or greater than 2% of its purchase price.

Similar to the 1% Rule, to check if a particular market or geographical area meets the 2% Rule, you can use the median monthly gross rent of a particular property type, divided by the median sale price of those properties.

Using the 1% and 2% Rules as Purchase Criteria

The 1% Rule and 2% Rule are most commonly used when performing a quick evaluation of rental properties or BRRRR’s, and when comparing potential investment properties with each other.

The rationale behind using these rules (and the rent to price ratio in general), is that they represent a measure of affordability and attractive valuations.

Ignoring all other factors, if a property’s monthly gross rent makes up a higher percentage of its purchase price, it may indicate a better deal for the investor. In other words, the investor is paying less for each dollar they are going to get back in rent.

Using this rationale, buy-and-hold investors who prefer properties with strong cash flow may use the 1% Rule as one of their screening criteria when analyzing rental properties. If they focus exclusively on cash flow, they may even try to find properties that fit the 2% Rule, although that can be quite rare in most markets.

For example, an investor may be looking at one property, which has a purchase price of $250,000 and potential rent of $1,750. The rent to price ratio of this property is $1,750 / $250,000 = 0.7%. This property doesn’t meet either the 1% or the 2% Rules.

Another property may be selling for $50,000 and could rent for $800 per month. Its rent to price ratio is going to be $800 / $50,000 = 1.6%, which puts it in between the 1% and 2% Rules.

Which of these properties is a better investment? Well, if you’re only considering the 1% and 2% Rules, then the second property may seem more attractive. However, as we’ll discuss in the next section, there can be many factors that would make the first property a better choice.

The Limitations of the 1% and 2% Rules

The simplicity of the 1% Rule and 2% Rule is the main source of their drawbacks and limitations. Both of these rules only consider a property’s potential gross rental income and purchase price, and ignore a myriad of other important factors.

For example, these rules completely disregard the following:

- Financing strategy: the type and cost of financing can drastically affect a property’s cash flow and investment returns. Moreover, focusing on properties that only fit the 1% or 2% Rules may change the types of loan programs available to investors

- Rehab work: these rules do not factor in any rehab work required to make a property rent-ready. A property may fit the 2% Rule, but require substantial rehab work and up-front capital investment to be rentable

- Vacancy rates: The 1% and 2% Rules don’t take into account the vacancy rates, which have a direct impact on a property’s cash flow and investment returns

- Operating expenses: These rules also completely ignore all expenses, including property taxes, maintenance, capital expenditures, management, and other fees

- Price and rent appreciation: finally, these rules do not take into account long-term price and rent growth, which can have a significant impact on long-term returns

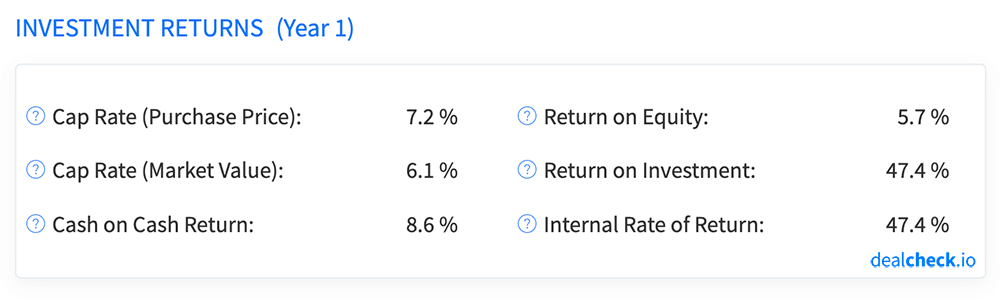

Because of these limitations, it’s important to always look at the 1% or 2% Rules in conjunction with other property analysis metrics, like the cash on cash return (COC), return on investment (ROI), and internal rate of return (IRR) when making investment decisions.

Why the 1% and 2% Rules Favor Cheaper Properties

Because the 1% and 2% Rules only take into account a property’s potential gross rent and price, and because the ratio between rent and price needs to be higher for these rules to pass, they tend to favor properties with cheaper prices and values.

For example, for a $500,000 property to meet the 2% Rule, it needs to rent for $10,000. Is that possible? Not likely. On the other hand, a $40,000 property needs to rent for only $800 to pass the 2% Rule – something that’s fairly common in many mid-west and southern markets in the United States.

However, properties that are sold at the lower price points which are necessary for these rules to work often come with a variety of issues that may not make them good long-term investments.

First, they are often located in neighborhoods and cities with poor macroeconomic conditions which are likely to see little price and rent appreciation – both key components of long-term rental returns.

Additionally, these properties are often located in distressed areas and attract lower-quality tenants, which may increase their vacancy rates, tenant turnover, issues with late payments or evictions, and increased wear and tear.

So, while properties that meet the 1% and especially the 2% Rule may seem attractive from the initial cash flow perspective, they are very likely to deliver sub-par long-term returns and cause issues for their landlords.

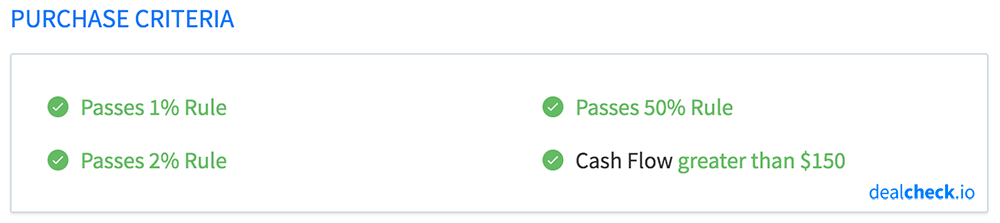

Calculate the 1% and 2% Rules and Dozens of Other Metrics in Seconds

The DealCheck property analysis app makes it easy to calculate and use the 1% Rule and 2% Rule, along with dozens of other property analysis metrics for both commercial and residential rental properties in seconds.

You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device.