The return on equity, abbreviated as ROE, is a measure of investment return that can be used to evaluate and compare rental properties, as well as assess their future performance.

The ROE is similar to the cash on cash return (COC), but instead of using the initial cash investment in its calculation, it uses the total equity in a property instead.

This makes it useful for understanding not just the initial cash yield a rental property can generate, but also how this yield will change over time, as the equity in a property grows. It is often used by investors as a criteria for planning the sale or a cash-out refinance of a property to re-deploy the built-up equity elsewhere.

The Return on Equity (ROE) Formula

The return on equity can be calculated by dividing a property’s yearly cash flow by the total equity in that property at the end of the year:

In this formula, a property’s cash flow is the yearly net profit it will generate after subtracting all expenses (including loan payments) from its income. Most investors use pre-tax cash flow when calculating ROE, although you can use after-tax cash flow as well.

The total equity in a property can be calculated by subtracting the current outstanding loan balance from the property’s market value. If no financing was used to purchase the property, the total equity simply equals the current market value of the property.

Return on Equity vs. Cash on Cash Return

The ROE and COC use very similar formulas for their calculations. Both use a property’s yearly cash flow in the numerator, but while the COC divides it by the original cash investment, the ROE divides it by the current equity in a property instead.

The initial ROE and COC projections for a given property (that is, the returns calculated at the time of purchase), will usually be the same. This is because the initial equity in a property will typically equal the cash that was spent to buy it.

However, while the originally invested cash number used by the COC calculation will remain the same throughout the years, the equity in a property will change over time – it will likely increase due to property value appreciation and the paydown of the loan balance.

So, while the COC always compares the yearly cash flow to the originally invested cash, the ROE presents a more dynamic return metric, based on the changing equity you have in a property at any particular year.

Using ROE as a Sale or Refinance Criteria

Since the return on equity and the cash on cash return are initially the same, the ROE does not offer additional insight as a purchase or investment criteria when buying new rental properties.

However, it is often used to track the cash yield of a property relative to the total equity in that property over time. Used this way, it can be viewed as a measure of how much cash flow the equity you have in a property is generating each year.

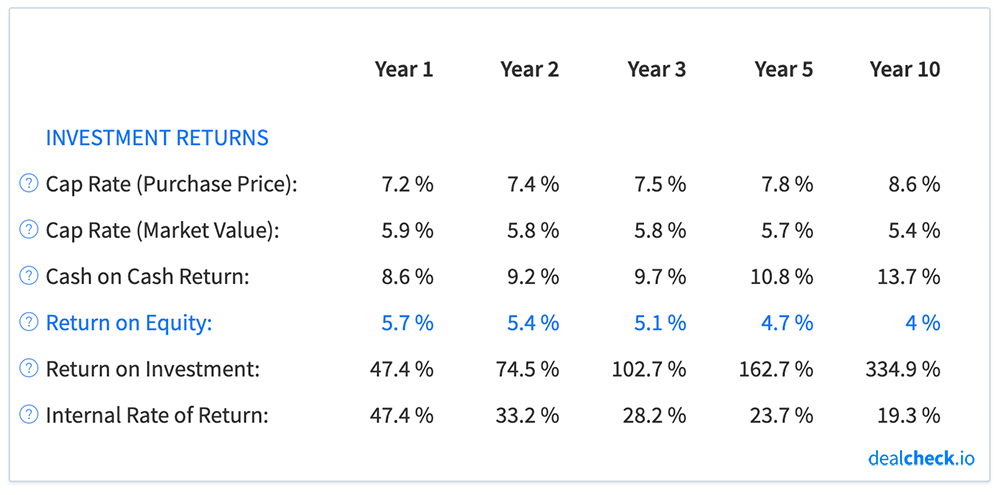

As you continue holding on to a property, your total equity will likely increase, which will cause the ROE to decrease over time:

Many investors use future ROE projections to help them determine an appropriate time to withdraw the equity they have built up via a cash-out refinance, or sell the property altogether if it’s no longer generating an acceptable return.

The rationale for this is that when you are growing your rental portfolio and actively looking to buy additional properties, the equity you have built up isn’t necessarily useful. It is often called “dead equity” for this reason.

When the ROE of a particular property falls substantially below the initial ROE (or COC) you can achieve through a new property purchase, it may make more sense to withdraw this equity via a refinance (or property sale), and re-allocate your capital to more profitable investments.

Calculate ROE and Dozens of Other Metrics in Seconds

The DealCheck property analysis app makes it easy to calculate the return on equity, along with dozens of other property analysis metrics for both commercial and residential rental properties in seconds.

You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device.