The rent to price ratio (RTP), also called the rent to value ratio (RTV), is often used by rental property investors when evaluating potential rental markets and specific investment properties.

This ratio can be used as a quick indicator to determine whether a particular rental market is undervalued or overvalued from an investment perspective. The RTP can also be used to compare relative valuations among neighborhoods and individual rental properties.

Buy and hold investors often use the “1% Rule” or the “2% Rule” as part of their purchase criteria, both of which rely on specific rent to price ratio values for their calculations.

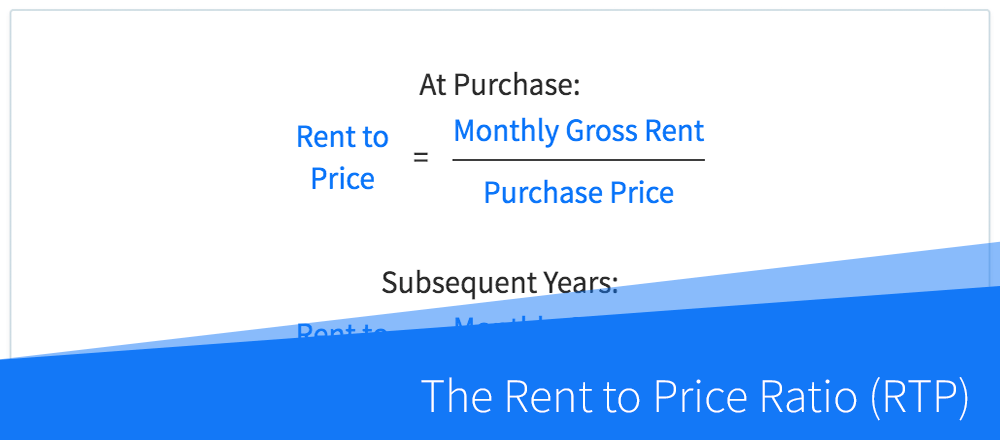

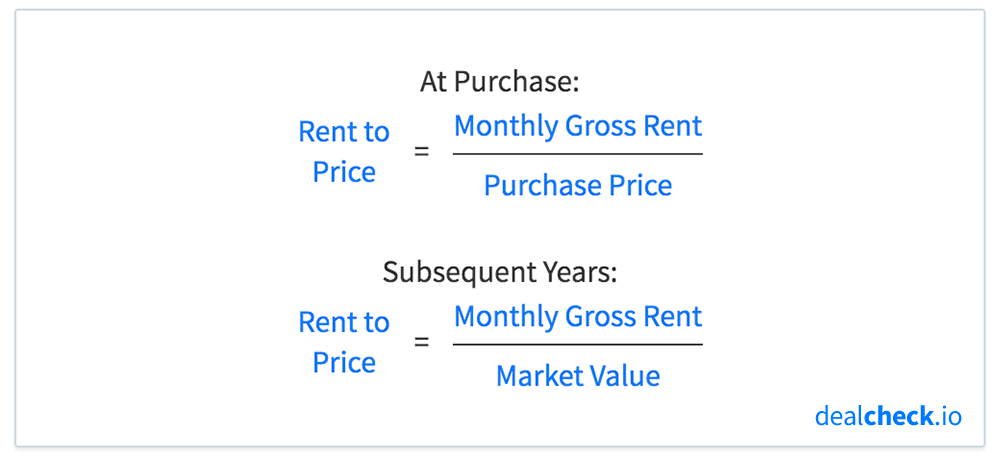

The Rent to Price Ratio (RTP) Formula

The rent to price or rent to value ratio can be calculated by dividing a property’s monthly gross rent by its purchase price or current market value, and is expressed as a percentage:

The first formula, which uses the property’s purchase price, should be used to calculate the RTP for new purchases, while the second, which uses the property’s current market value, can be used to calculate the rent to value ratio in subsequent years of ownership.

To calculate the rent to price ratio of a market or geographical area, you can divide the median monthly gross rent of a particular property type by its median sale price.

Using the RTP to Compare Rental Markets

Real estate investors often use the rent to price or rent to value ratio when evaluating and comparing potential rental markets.

Let’s assume you’re interested in buying 3 bedroom single-family rental properties. In the first market you look at (Market A), these properties rent for $2,400 a month and sell for about $250,000, so you calculate the rent to price ratio of that market to be $2,400 / $250,000 = 0.96%.

In a different market (Market B), the same properties rent for $1,500 a month, and sell for $120,000, which puts their RTP at $1,500 / $120,000 = 1.25%.

While the higher monthly rents may seem more attractive in Market A, it is actually more expensive to buy rental property there, as indicated by its lower rent to price ratio. Even though the potential gross rents may be higher, you will be paying more in purchase price for every dollar you get back in rent.

In Market B, on the other hand, the median rents are lower, but the market overall is more attractive from a valuation perspective, as indicated by its higher rent to price ratio.

Not considering any other factors, Market B presents a more attractive investment opportunity between the two.

Using the 1% or 2% Rules as Purchase Criteria

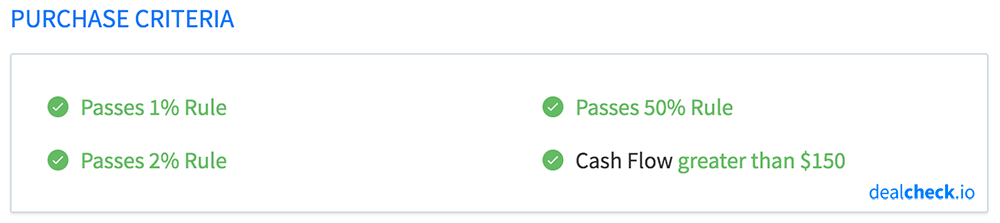

The rent to price ratio is often used in the context of the so-called “1% Rule” or “2% Rule” when selecting and screening potential rental markets and investment properties.

The 1% Rule requires the rent to price ratio to be 1% or higher, while the 2% Rule requires RTP to be 2% or higher.

These rules can be used as a quick measure of the affordability and attractive valuation of rental properties in a given area.

Buy and hold investors who focus on markets with a strong cash flow, as well as good long-term price and rent growth would typically use the 1% Rule as their screening criteria for rental properties.

Investors who focus exclusively on high cash flow and yields, may set their criteria higher and use the 2% Rule instead.

In either case, it’s important to understand that the 1% and 2% Rules, as well as the rent to price ratio in general, are not without limitations. They only take into account the property’s gross rent and purchase price, without considering the acquisition or financing strategies, the rehab work, operating expenses, or long-term price and rent appreciation.

That’s why it’s important to consider the rent to price ratio in conjunction with other property analysis metrics, like the cash on cash return (COC), return on investment (ROI), and internal rate of return (IRR) when making investment decisions.

Calculate RTP and Dozens of Other Metrics in Seconds

The DealCheck property analysis app makes it easy to calculate the rent to price ratio, along with dozens of other property analysis metrics for both commercial and residential rental properties in seconds.

You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device.