The gross rent multiplier, abbreviated as GRM, is an indicator of rental property performance, commonly used to evaluate and compare both residential and commercial rental investments.

In simple terms, this property analysis metric shows you the number of years it will take for the yearly gross rent of a property to add up to its original purchase price or market value.

The gross rent multiplier can be used to compare different rental properties and find undervalued deals, as well as to estimate the potential value of a property, given the typical GRM of the surrounding market.

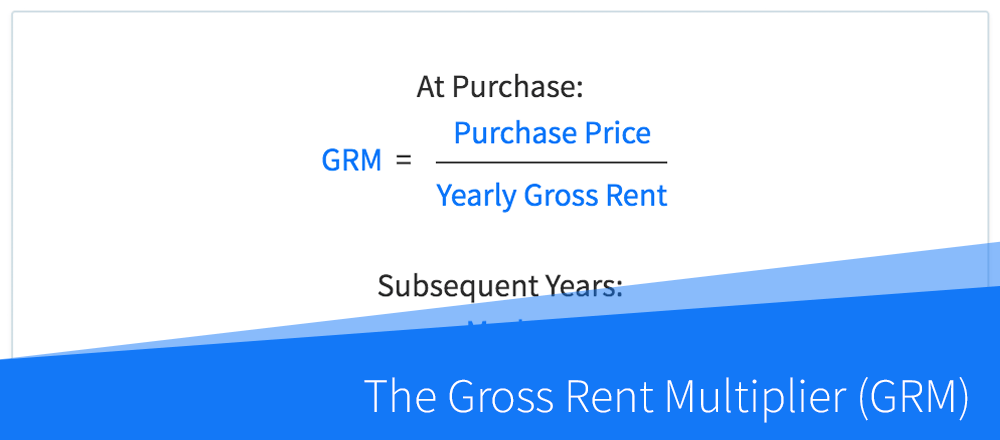

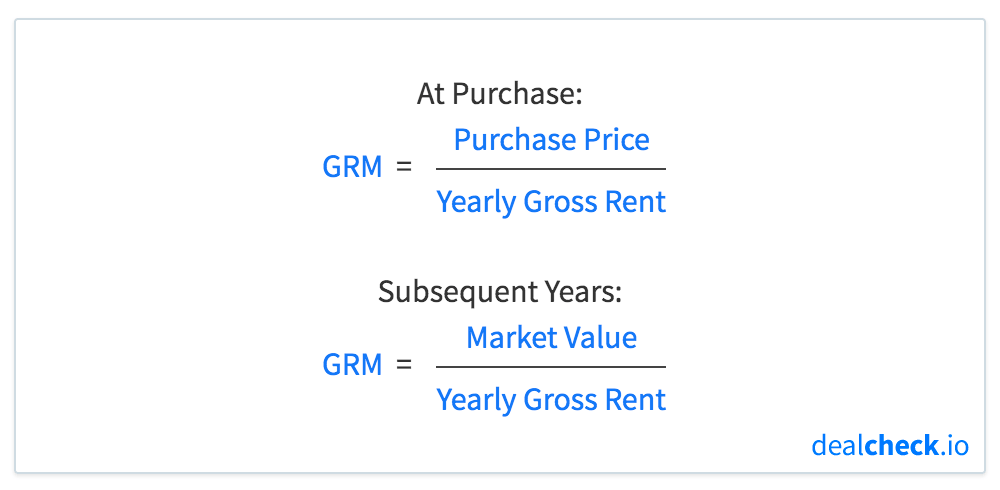

The Gross Rent Multiplier (GRM) Formula

The gross rent multiplier is calculated by dividing the property’s purchase price (or its market value) by its potential (or actual) yearly gross rent:

Investors would typically use the purchase price in the above formula when evaluating new investment properties, and the market value when calculating the GRM of properties they already own.

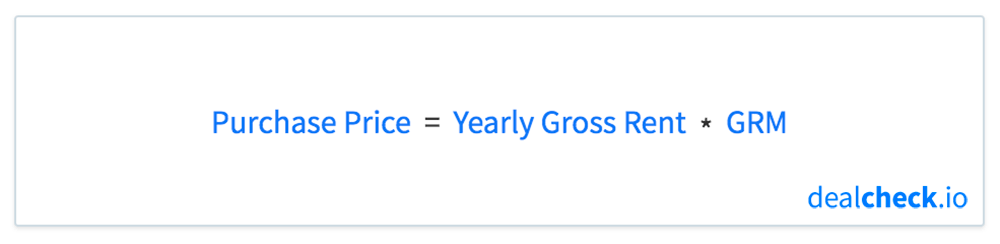

By rearranging the GRM formula above, you can also calculate the property’s potential value or purchase price, if you know the average gross rent multiplier of the surrounding market and the property’s yearly gross rent:

Using the Gross Rent Multiplier to Compare Properties

A primary use case for the gross rent multiplier is comparing different rental properties and finding potential investments with a lower valuation.

The lower the GRM of a particular property, the less you will be paying for every dollar of potential gross income. A property with a lower GRM, as compared to alternative investments, is therefore an indication that it may be undervalued.

On the other hand, a higher gross rent multiplier is an indication that the property is priced higher, at a less attractive valuation when looking at its potential gross income.

The actual figure for the GRM will vary between different markets and property types, so it’s difficult to recommend a “good” or “bad” GRM. However, it’s reasonable to target properties with a GRM less than 10x – 12x. You may also want to be cautious when seeing GRM values below 3x – 5x, as the property’s gross rent may be inflated.

Calculating a Property’s Value Using the GRM

Another use case for the gross rent multiplier is calculating a property’s estimated value in a process called reverse valuation analysis.

If you know the average or typical gross rent multiplier of the surrounding market, as well as the property’s yearly gross rent, you can use the rearranged formula above to determine the value of the property by multiplying its yearly gross rent by the average GRM.

When using this valuation approach, it is important to have accurate figures for the property’s gross rent and the average GRM of the market, as well as to keep in mind the limitations described in the following section.

Limitations of the Gross Rent Multiplier

The biggest limitation of the gross rent multiplier is the fact that it does not take into account vacancy, operating expenses, financing costs, depreciation, and other factors that affect a property’s potential cash flow and net profit.

To illustrate this, consider a market where it’s typical to see GRMs between 7x – 8x. If you come across a property with a GRM of 6x, you may at first glance consider it a good deal.

Upon further examination, however, you determine that it is in a rougher neighborhood, with higher expected vacancies and turnover, and larger maintenance costs. This, in turn, would negatively impact the property’s cash flow and it will actually generate less profit than properties with higher GRMs, but in better areas.

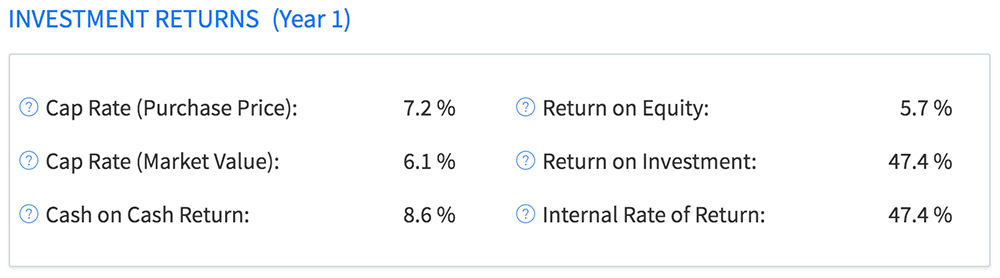

Because of this limitation, the gross rent multiplier should not be considered in isolation, but together with other profitability indicators like the cash on cash return (COC), return on investment (ROI) and internal rate of return (IRR).

Calculate GRM and Dozens of Other Metrics in Seconds

The DealCheck property analysis app makes it easy to calculate the gross rent multiplier, along with dozens of other property analysis metrics for rental properties, BRRRRs and commercial buildings in seconds.

You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device.