The debt service coverage ratio (DSCR), also called the debt coverage ratio (DCR), is often used by real estate lenders when underwriting loans for rental properties, especially when working with commercial real estate.

The DSCR is an indicator of whether a property’s net operating income (NOI) is sufficient to cover its loan payments in any given year.

This ratio can be used to assess the level of risk when underwriting an investment property, as well as the level of a safety net the property’s NOI provides, should market conditions deteriorate.

The Debt Service Coverage Ratio (DSCR) Formula

The debt service coverage ratio can be calculated by dividing a property’s yearly net operating income (NOI) by its yearly deb service:

A property’s net operating income can be calculated by subtracting all operating expenses from the operating income. In other words, it is the net income a property owner will receive before accounting for loan payments, depreciation and capital reserves.

A property’s debt service is simply the sum of all loan payments (principal and interest only) that the owner will pay for that property.

Understanding What the DSCR Means

Suppose a potential investment property has a yearly net operating income (NOI) of $100,000 and an annual debt service of the same amount – also $100,000. In this case, the debt service coverage ratio of this property is 1.0x.

In other words, the NOI of this property is just enough to cover the loan payment obligations, but not a dollar more.

If the net operating income of this property was higher, let’s say $120,000, the DSCR would be higher as well, 1.2x in this case. This would indicate that the property generates enough income to cover the loan payments, as well as provide a 20% cushion in case the NOI declines in the future.

On the other hand, if the net operating income of this property was lower, for example, $80,000, the new DSCR of 0.8x would indicate that the property does not generate enough income to cover its debt service obligations.

How Lenders Use DSCR To Assess Underwriting Risk

The debt service coverage ratio is commonly used by lenders when underwriting investment property loans to estimate their underwriting risk, as well as to help them determine the maximum loan amount they are willing to underwrite.

A lender would always like to see a debt service coverage ratio of above 1.0x, with 1.2x – 1.4x being a common requirement among commercial lenders.

What this means is that the lender would like to see the property’s net operating income be sufficient to cover the loan payments on the new loan, as well as provide a safety net in case the NOI declines in the future, for example, due to higher vacancies or increased expenses.

A lender’s debt coverage ratio requirement may vary depending on the market or asset type. They may accept a lower DSCR for stabilized properties in strong markets but have higher DSCR requirements for riskier investments.

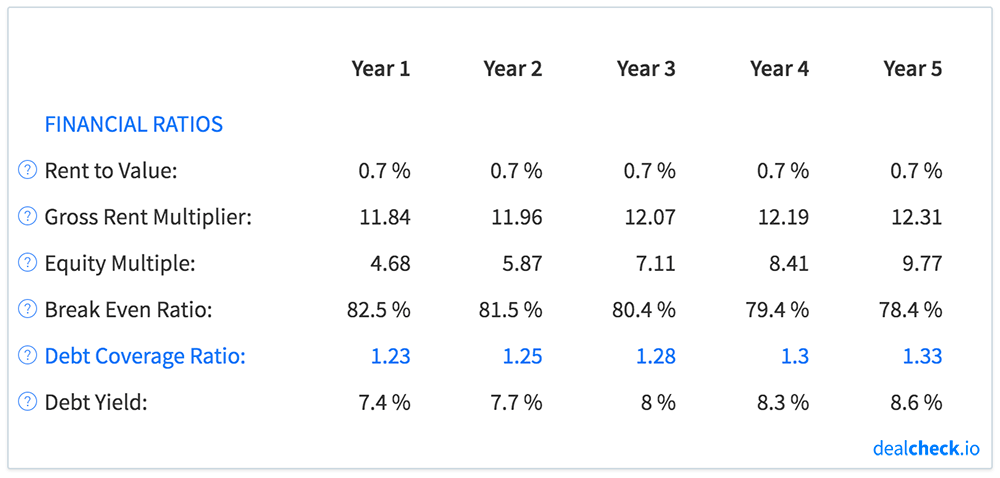

A lender will also often look at the projected debt service coverage ratio over several years of property ownership. They would typically be looking at an increasing DSCR, which would indicate that the property’s net operating income is increasing over time:

Adjustments to NOI When Calculating DSCR

One other thing to keep in mind is that lenders may make adjustments to the net operating income (NOI) calculation prior to calculating the debt service coverage ratio for a particular property.

This is often done to give a lender a more conservative look at a property’s projected NOI. However, this will typically result in a lower debt coverage ratio, than if no adjustments were made.

For example, a lender may subtract capital reserves or expenditures, or make-ready improvements from the NOI – items that are not typically included in the NOI formula. Depending on the dollar value of these items, it may cause the DSCR to fall below the lender’s minimum requirements, which may affect your ability to get your loan approved.

It’s always a good idea to check with your lender about their specific method of calculating the debt coverage ratio, so you can account for it when estimating this ratio yourself.

Calculate DSCR and Dozens of Other Metrics in Seconds

The DealCheck property analysis app makes it easy to calculate the debt service coverage ratio, along with dozens of other property analysis metrics for both commercial and residential rental properties in seconds.

You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device.