The cash on cash return, often abbreviated as COC, is a popular measure of investment return used when evaluating residential and commercial rental properties.

The COC shows a projected cash yield you will receive from a rental property and can be used both to compare investment properties, as well as to compare rental properties with other asset classes, such as stocks or bonds.

Although not without limitations, the cash on cash return is often one of the primary criteria used by investors when analyzing rental properties, especially by those who are primarily interested in cash flow.

The Cash on Cash Return (COC) Formula

The cash on cash return can be calculated by dividing a property’s yearly cash flow by the total capital or funds invested in that property:

In the formula above, a property’s cash flow is the yearly net profit it will generate after subtracting all expenses (including loan payments) from its income. Note that most investors use pre-tax cash flow when calculating COC, although on some occasions they may use after-tax cash flow.

The total invested capital represents all cash that was originally used to purchase the property and bring it to a rent-ready condition. This typically includes the down payment on the loan (or the purchase price, if not using financing), purchase and closing costs, as well as any up-front rehab costs.

Cash on Cash Return Example & Explanation

Let’s assume you’re looking at a rental property that will generate $6,000 cash flow in the first year, and your combined down payment, purchase and rehab costs will be $40,000.

In this scenario, the cash on cash return (COC) for the first year would be $6,000 / $40,000 = 15%. This means that in the first year of ownership, you will receive a cash yield of 15% on your initial invested capital.

So, what is a good cash on cash return? As with most property analysis metrics we’ve discussed on our blog, there isn’t a universal target number that will apply in all cases.

Investors who primarily invest for the purpose of generating cash flow from their properties may consider 12% – 15% a minimum when evaluating potential investments. On the other hand, investors who like a mix of appreciation and cash flow may be fine with a COC of less than 10%, as long as the property meets their other criteria.

Limitations of the Cash on Cash Return

Although the cash on cash return is an important rental property performance indicator, you should be aware of its limitations when using it to screen potential investments.

First, looking only at the first year COC can sometimes be misleading, especially if the cash flow from the property in the first year is expected to be different than in subsequent years. This may happen, for example, if the current rents are either too high or too low and are expected to change in the future.

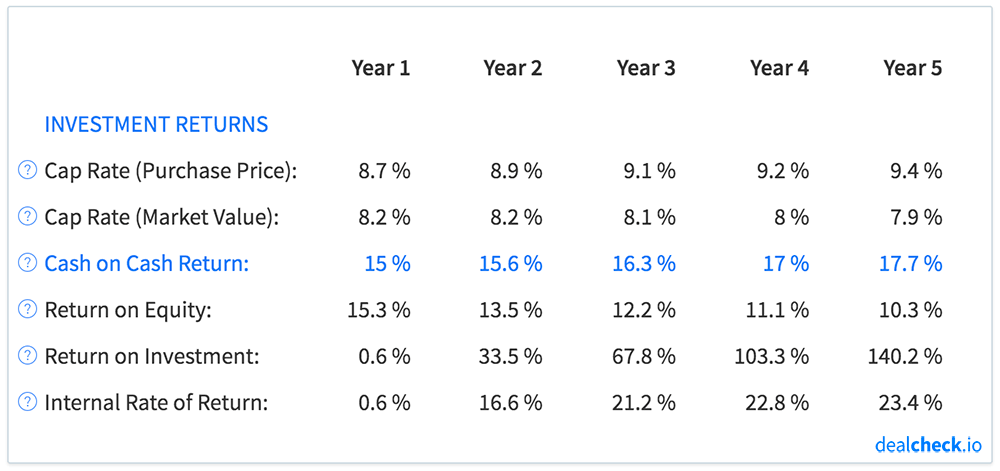

To work around this, look at the cash on cash return during the first year, as well as during subsequent years of ownership to see how it will change over time:

Second, since the cash on cash return only includes the net cash flow from a property, it does not take into account other important ways a rental property can make you money, specifically through price appreciation and loan paydown.

That’s why when considering the total return that can be gained from a rental property, it is important to also look at the return on investment (ROI) and internal rate of return (IRR) metrics, both of which include the potential price appreciation and loan paydown in their calculations.

Calculate COC and Dozens of Other Metrics in Seconds

The DealCheck property analysis app makes it easy to calculate the cash on cash return, along with dozens of other property analysis metrics for both commercial and residential rental properties in seconds.

You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device.