The break-even ratio, abbreviated as BER, is most commonly used as un underwriting criteria by commercial real estate lenders, although it is a useful metric to know when analyzing any rental property.

The break-even ratio shows the minimum percentage of occupancy needed to cover all operating expenses and debt service obligations for a rental property.

It can be used to assess the vulnerability of a particular rental investment to changing market conditions (especially higher vacancies) and can be viewed as a safety net provided to the investor.

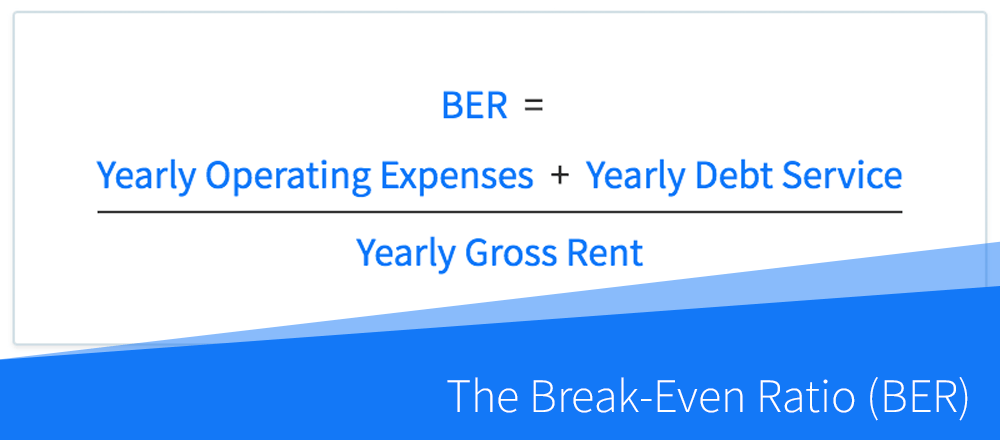

The Break-Even Ratio (BER) Formula

The break-even ratio can be calculated by dividing a property’s yearly operating expenses and debt service by its potential yearly gross rent:

A property’s operating expenses include all expenses incurred during its normal operation, including property taxes, insurance, property management fees, maintenance, legal and administrative fees.

A property’s debt service is simply the sum of all loan payments (principal and interest only) you will pay for that property.

What Is a Good Break-Even Ratio?

When a lender is underwriting a potential investment property, they will often look at the break-even ratio to estimate how vulnerable that property is to defaulting on their loan payments.

For example, consider a property with annual operating expenses of $50,000, annual debt service of $90,000 and annual rents of $180,000. In this case, the break-even ratio is calculated to be 77.78%.

This tells you that the property must be at least 77.78% occupied to cover all of its expenses and loan payments. Or, in other words, the maximum vacancy rate for this property is 22.22%.

Whether this is a good or bad BER depends on the average vacancy rates of properties of the same type in the local market. If let’s say, the average vacancy of similar properties is 10%, then this property’s 77.78% break-even ratio provides a healthy safety net in case vacancies increase.

However, if the average market vacancy rate was closer to 15-20%, the lender may examine this investment more closely, as it provides less of a cushion should local vacancy rates increase.

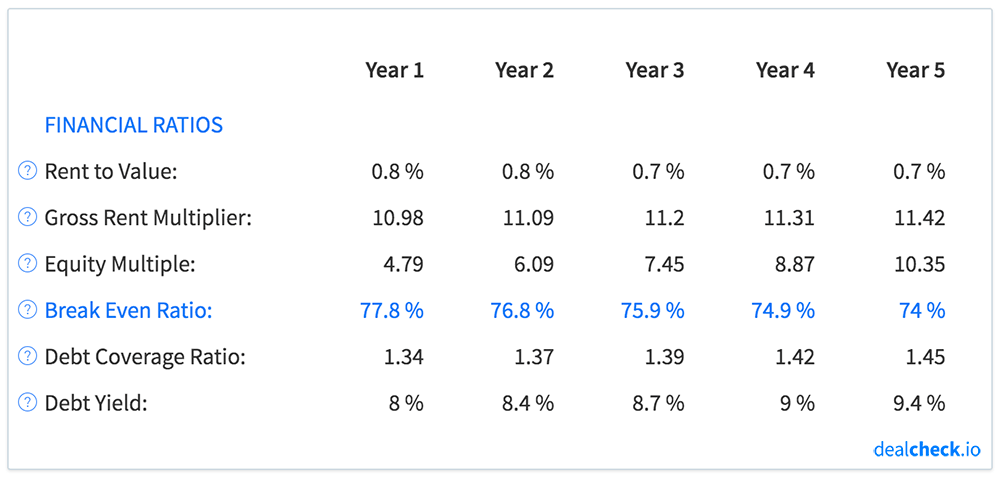

In that case, a lender may look at the projected break-even ratio over several years of ownership and look for a favorable trend of a decreasing BER below acceptable levels:

Calculate BER and Dozens of Other Metrics in Seconds

The DealCheck property analysis app makes it easy to calculate the break-even ratio, along with dozens of other property analysis metrics for both commercial and residential rental properties in seconds.

You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device.