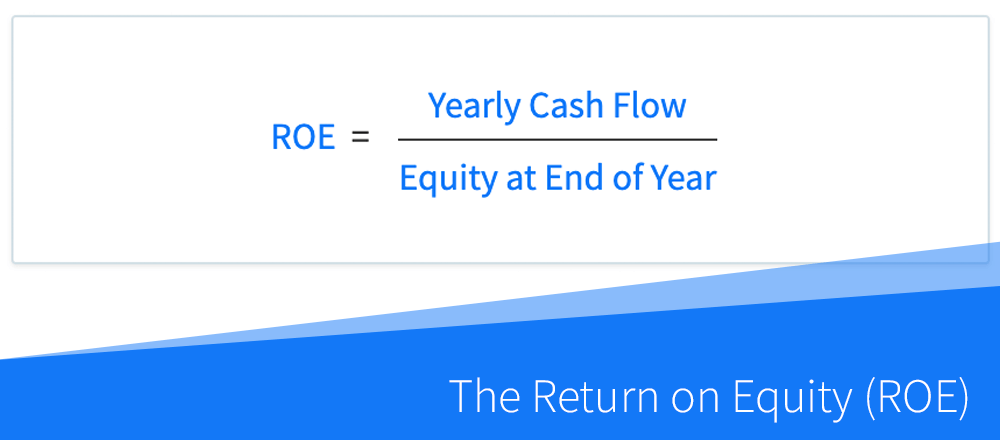

The return on equity, abbreviated as ROE, is a measure of investment return that can be used to evaluate and compare rental properties, as well as assess their future performance. The ROE is similar to the cash on cash return (COC), but instead of using the initial...