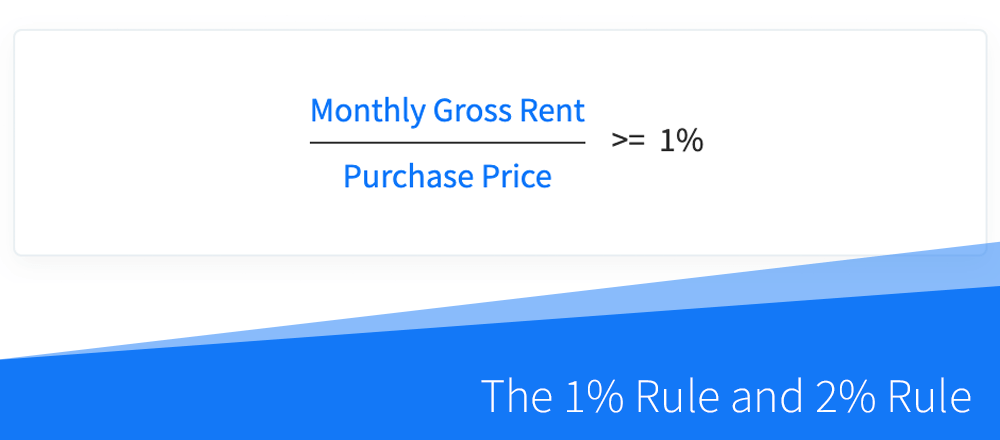

The 1% Rule and 2% Rule are often used by real estate investors as purchase and investment criteria when evaluating rental properties and BRRRR's prior to their purchase. They can also be used as general valuation criteria when comparing the affordability of...