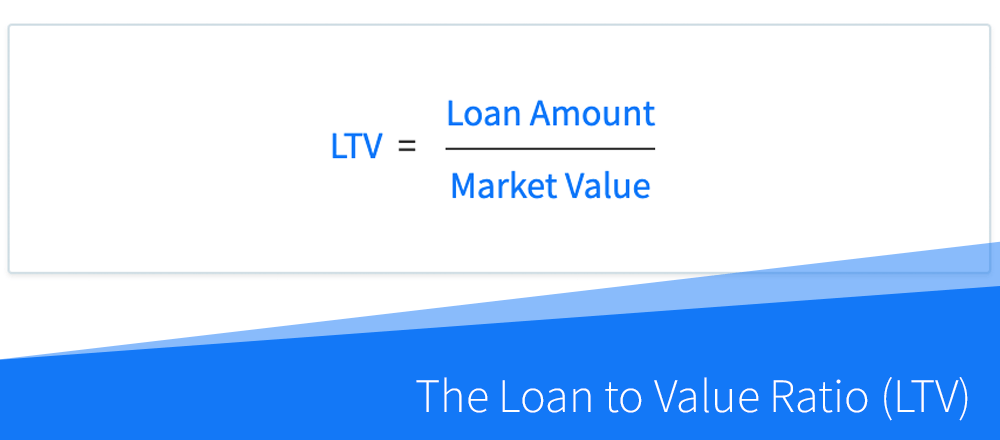

The loan to value ratio (LTV) is one of the primary metrics used by real estate lenders when underwriting loans for rental properties, BRRRR's and flips. Simply put, it shows the percentage of a property's value that is taken up by the loan amount. For lenders, it is...