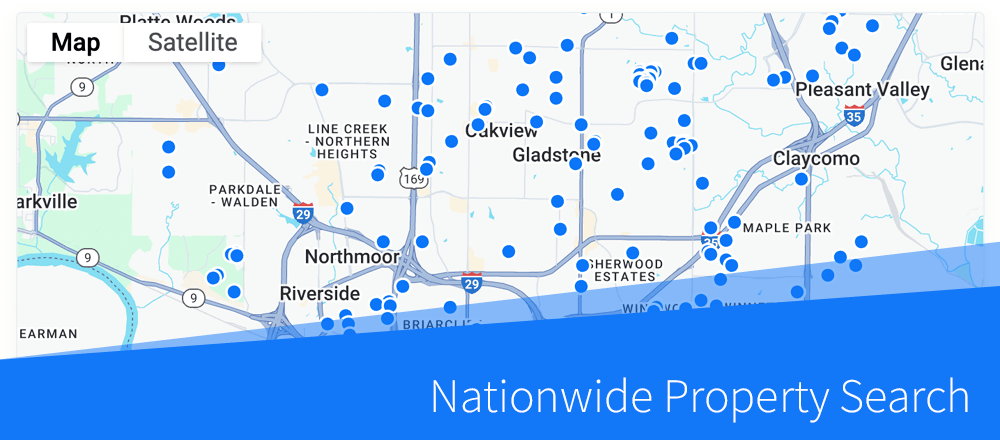

After many months of hard work, we're super excited to share our new nationwide property search, which makes it even easier to find the best real estate deals with DealCheck: Search Property Listings Nationwide No need to use any third-party websites - you can now...